The coronavirus crisis has severely affected numerous sectors, from aviation, and tourism, to oil and gas even property.

The World Bank noted in its recent ‘Global Economic Prospects’ report that the pandemic has caused the broadest collapse of the global economy since 1870. According to the report, the world economy is projected to contract by 5.2 percent this year, the worst recession in 80 years.

Media reports have stated that there have been at least 15 global economic crises since 1990 of which some were due to stock market crashes, currency crises and sovereign default. Nevertheless, the economic costs associated with the COVID-19 pandemic goes beyond the previous crises, said Dr Foo Chee Hung, manager of product research and development for MKH Bhd, a diversified property developer based in Malaysia.

Malaysia is reported to be facing the worst economic recession in its history. The ASEAN member state recently announced that it will go into a ‘COVID-19 recovery phase’ starting 10 June after being under partial lockdown since mid-March.

Finance Minister Tengku Zafrul Tengku Abdul Aziz said that in the first two weeks of the partial lockdown, Malaysia’s economic growth, which was previously at two percent, declined to 0.5 percent.

Based on the Department of Statistics Malaysia, the country's gross domestic product (GDP) grew at just 0.7 percent, down from 3.6 percent in the fourth quarter of 2019. This is the lowest growth recorded since the third quarter of 2009 – negative 1.1 percent.

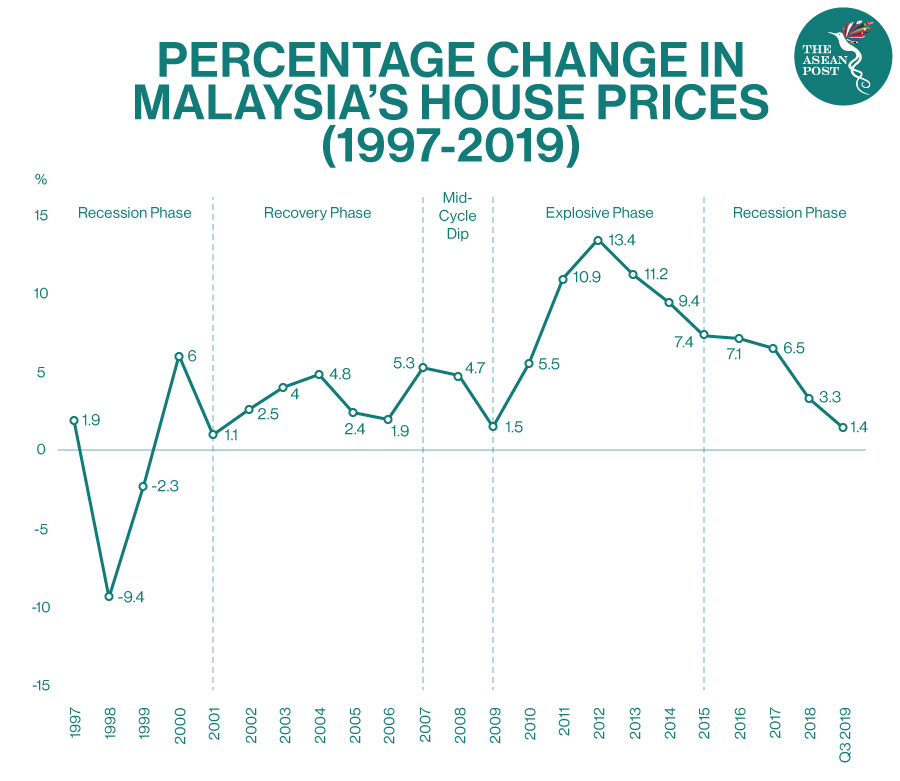

In recent years, Malaysia’s property market has been resistant in terms of price. Dr Foo Chee Hung stated in his recent article titled ‘COVID-19: How will Malaysia’s housing market perform?’ that over the last 3 decades, house prices in the country only suffered a decline between 1998 and 1999 which was due to the lingering effects of the 1997 Asian Financial Crisis.

The country’s partial lockdown – known locally as the Movement Control Order (MCO) – has contributed to a decrease in number of home seekers and has also delayed property listings. Other than that, processes like completing documentation and progress payments have had to be halted as financial institutions scaled down operations during the MCO. Moreover, developers and builders are unlikely to meet their completion deadlines as supply chains have been interrupted.

Lim Boon Ping, President of Malaysian Institute of Estate Agents (MIEA) said in an online ASEAN Real Estate Forum that as a result of the pandemic, the Malaysian real estate market will shift to a buyer’s market from a previously seller’s market. He also believes that property prices in the country could decline by 10 to 20 percent.

“While it is still too early to predict the quantum and economic costs brought by COVID-19 on the property market, the transaction volume and value of property will inevitably decrease in the first half of 2020,” explained Dr Foo. He also added that it is likely that house prices in Malaysia will drop for the first time since 1999.

18-Year-Cycle

iProperty, a Malaysia-based property and real estate website, released a report on the effects of the COVID-19 outbreak on Malaysia’s property landscape.

According to the iProperty publication, the property market is cyclical in nature with “booms and bursts” that follow the economic cycle: “an ‘expansion’ with upward pressure on house prices, followed by a downswing in house prices – ‘recession’ – as the market hit the bottom of the cycle, and then with a ‘recovery’ as the market builds towards the next boom.”

After the 1997 Asian Financial Crisis, Malaysia’s property market entered into the recovery phase in 2001. The mid-cycle dip took place between 2007 to 2009, in conjunction with the subprime mortgage crisis. Malaysia’s property market then embarked on the explosive phase after 2009. Based on data by iProperty, prices started to escalate from 2010 to 2015, and soared up to 13.4 percent per annum in 2012. Then in 2015, the recession phase kicked in as a result of a weakened Malaysian currency against other major currencies, overhang in properties, mismatch of house prices and affordability among other factors.

iProperty noted that the recession phase which started in 2015 was supposedly due to end in 2019, with the property market entering its recovery phase in 2020 – based on the 18-year principle. Nevertheless, with the current coronavirus crisis and economic uncertainties, the following phase of recovery will perhaps only start in 2021. Assuming that this phase will last for another seven years, the next explosive phase would likely begin in 2028.

Related articles: