Ever since the advent of the internet and the proliferation of smartphones, traditional media such as television and radio no longer have the same kind of mainstream influence as they used to. With growing high-speed internet penetration all over the world, streaming platforms are now raking in the big bucks. According to the We Be Social and Hootsuite 2019 digital report, consumers worldwide spent US$12 billion on digital music streaming in 2018 – an eight percent increase from the US$11.2 billion in 2017.

The music streaming industry in the region is rapidly growing. Chinese and Taiwanese companies such as Joox and KKBox have made inroads here, becoming two of the more popular streaming platforms in Southeast Asia. Aside from that, local start-ups too are beginning to launch their own streaming services, with more localised content to promote their respective music industries. Not to mention that big streaming conglomerates such as Spotify, Tidal and Apple Music are also looking to penetrate markets in the region.

Diversity is a good thing

The assortment of music streaming apps available is indirectly related to higher internet penetration rates across Southeast Asia. In the We Be Social and Hootsuite digital report, most of Southeast Asia’s population uses a broadband mobile connection. Furthermore, the middle-class segment of the population in the region is growing. The increase in disposable income allows people to pay more for entertainment which has also led to the proliferation of streaming services.

The growth in internet penetration has also consolidated the region’s digital economy. In a report released last year by Google in collaboration with Singapore’s Temasek, it is believed that Southeast Asia’s digital economy is forecasted to grow more than six-fold, becoming a staggering US$240 billion economy by 2025.

Revenue from the Asian music streaming industry in 2017 was US$1.2 billion. In a report from McKinsey & Company in 2016, the digital music streaming business in Asia at the time was growing 20 times faster than the global rate. The report also indicated that one of the main engines of growth was the youth market, particularly those under 35 years of age.

It’s not all Spotify and Apple Music

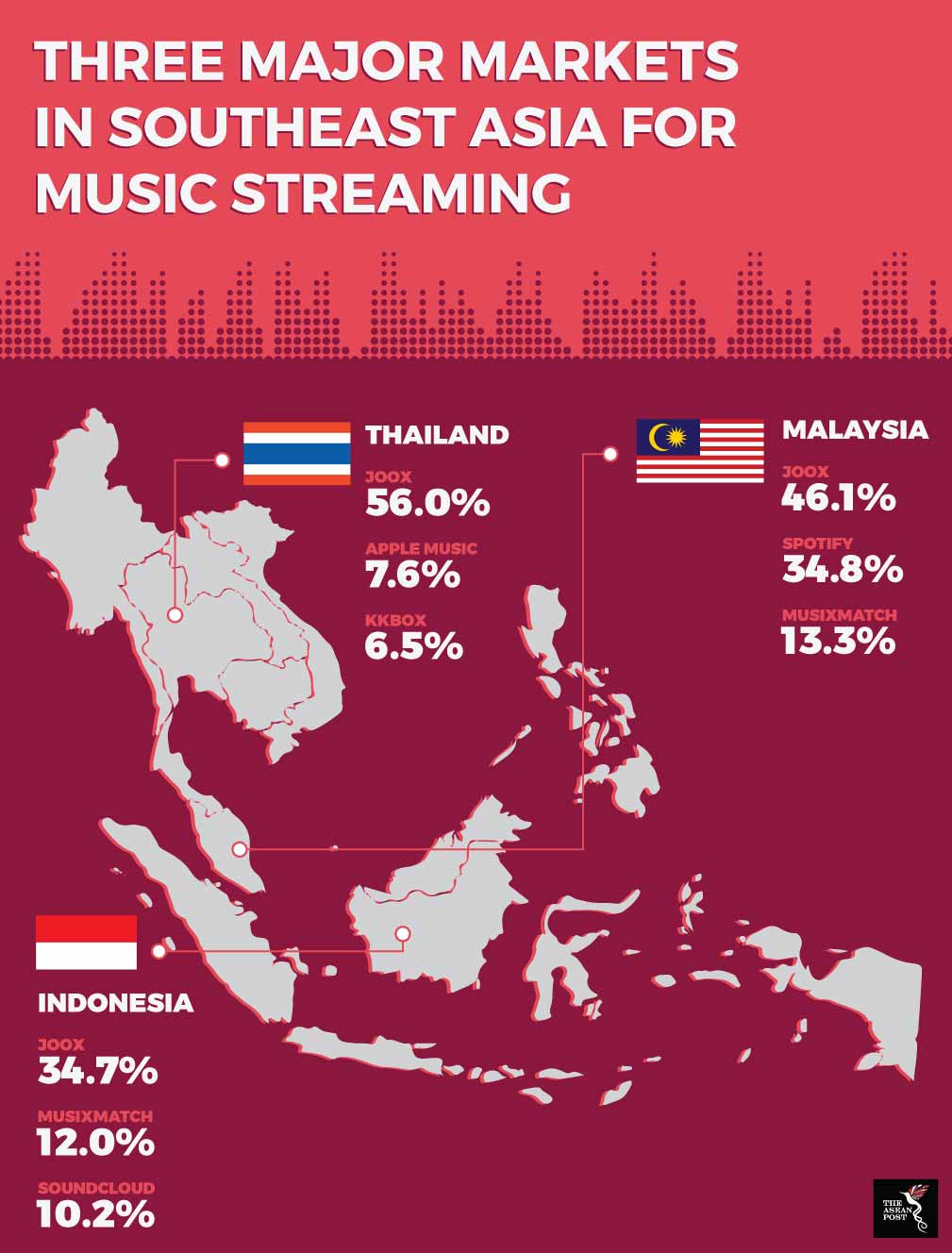

While Spotify and Apple Music might dominate the music streaming market in the West, Tencent’s JOOX is dominating markets in this part of the world. JOOX made inroads into the region early, making a presence for themselves in Hong Kong, Thailand, Malaysia, Singapore and Indonesia. According to the McKinsey report, JOOX accounts for more than 50 percent of all music streaming app downloads in Asian markets with over 50 million downloads.

Tencent is also looking to further consolidate its dominance in the music streaming industry with a recent strategic partnership with Spotify. Spotify is hoping that Tencent could help them make inroads into the China market.

Another big music streaming platform in Southeast Asia is Taiwan-based KKBox. Established in 2004, KKBox is a big player in countries like Malaysia, Singapore and Thailand. KKBox mainly caters to Mandarin-speaking users by collaborating with Mandopop and Taiwanese artistes.

Global streaming giant Spotify is also relatively big in the region. Unlike their rivals Apple Music that is available worldwide, Spotify is available in just eight countries in Asia, with five in Southeast Asia. At the moment, Spotify is only available in Singapore, Malaysia, Thailand, Indonesia and the Philippines. However, there is talk that Spotify is looking to expand to Vietnam.

One of the main reasons JOOX and KKBox are so successful in the region is because of their localised content. JOOX curates its selections based on its users and their locations, while KKBox works with artistes that are popular in the region. Spotify is trying to catch up by offering playlists that include local music and by also hosting events that feature local talent.

Aside from the main players, there are also local start-ups in the region looking to offer a different experience compared to the bigger music streaming companies. For example, Thai start-up Fungjai was established to promote less commercially viable artistes, such as indie and underground bands. In the future, we can expect to see more of this. As bands and artistes in the region rarely ever expand outside their borders, regional and local music streaming platforms will be essential in helping them gain a larger audience. Part of this is largely due to the algorithms implemented by streaming giants such as Spotify and Apple Music that target mainstream and international artists, dismissing local hidden gems that many listeners would like to discover.

The growth of music streaming platforms in the region could be a boon for the music industry too, as it allows up and coming bands and musicians to connect to a much wider audience, transcending national borders.

This article was first published by The ASEAN Post on 8 July 2018 and has been updated to reflect the latest data.

Related articles: