It is no secret that the COVID-19 pandemic has accelerated the adoption of a digital culture worldwide. Governments have imposed lockdowns and movement controls as preventive measures against the deadly outbreak. Urged to stay home and practice social distancing – people are now working from home, buying groceries online and using digital wallets. It seems like almost everyone has become a digital native.

ASEAN member states are no exception. Southeast Asia is one of the most vibrant regions when it comes to the digital economy; a place where the growth of internet users and digital consumers has been exceptional. Based on a 2019 report by Bain & Company and Facebook, digital consumers in the region have grown from 90 million in 2015 to 250 million in 2018. This number is expected to grow 1.2 times by 2025.

Many organisations such as Accenture, iPrice and Facebook have conducted extensive research on digital consumer trends in Southeast Asia amid the coronavirus crisis. As more people are staying indoors, they rely more on technology to keep them entertained and to carry out daily tasks.

Bain & Company and Facebook recently released another report titled ‘Southeast Asia Digital Consumer Trends that Shape the Next Normal’ which explores the consumption themes that emerged for Southeast Asian consumers and would perhaps continue even after lockdowns and restrictions are eased or lifted.

The combined research analysis is based on digital consumer trends for April 2020 across ASEAN member states Indonesia, Malaysia, Philippines, Singapore, Thailand and Vietnam; as well as interviews with close to 20 senior executives and venture capitalists in the region.

Essential Shopping

Bain & Company and Facebook revealed that at least 44 percent of digital consumers in ASEAN have spent more on packaged and fresh groceries online amid the outbreak.

Online shopping is nothing new in the region as noted in a study by Google, Temasek and Bain & Company – the e-commerce sector in Southeast Asia was worth US$38 billion in 2019 and is projected to grow rapidly. Nevertheless, in the 2019 Bain & Company and Facebook report mentioned earlier, “one of the largest untapped opportunities for online spend lay in groceries: a US$350 billion market in Southeast Asia with 0.3 percent penetration in the region” was much lower compared to other categories.

But the COVID-19 pandemic has accelerated the online grocery trend and it is here to stay. Among consumers who have been buying since April, at least 80 percent indicated that they plan to continue purchasing groceries online even in a post-pandemic world.

New Apps

As mentioned earlier, consumers are turning to digital devices to keep themselves occupied while staying indoors, resulting in the usage and adoption of different digital apps. This trend will likely continue, stated Facebook and Bain & Company.

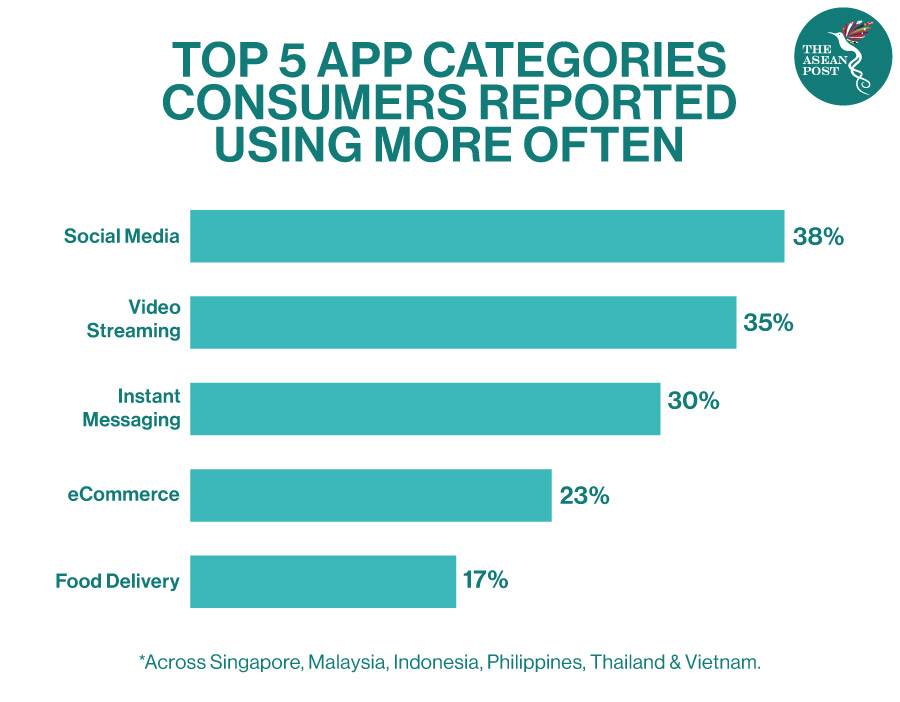

85 percent of digital consumers across Southeast Asia said they have tried new digital apps during the first quarter of 2020. Apps that have seen the highest increase in first-time and continued usage are social media, video streaming and instant messaging.

“When divided by age groups, categories such as social media, video streaming, and instant messaging continue to lead the pack, as these apps saw nearly similar spikes in usage across all age groups. Meanwhile, among middle-aged groups (25 to 54 years old), apps that saw relatively higher usage were e-commerce, food delivery, and digital payments. Among youths aged 18 to 24, it was short videos, music, and gaming,” noted the report.

Health And Welfare

It’s no surprise that the COVID-19 pandemic has led to a global health crisis – people have become more cautious and focused on their health and safety.

In Southeast Asia, 73 percent of consumers said they were likely to be more health conscious even after the pandemic has cleared, compared with 40 percent in the United States (US).

‘At Home’ And Contactless

Following recent events, “consumption habits in Southeast Asia have become more digital and home-centric as consumers are less likely to leave their homes,” said Bain & Company and Facebook.

It was reported that 77 percent of Southeast Asians are now preparing food at home more often, whereas around 65 percent are watching more on-demand and broadcast television.

The study by Bain & Company and Facebook suggests that this behaviour would perhaps stay as ASEAN consumers adopt more favourable attitudes to working from home while using remote-presence apps more often.

Other than that, contactless payments are rising amid the pandemic. The 2019 World Payments Report shows that the value of non-cash transactions in Asia is projected to grow from US$96.2 billion in 2017 to US$352.8 billion by 2022. With many service providers and food services offering contactless options paired with the change in consumer behaviour during the crisis, the demand for digital and contactless payments will increase.

Many consumers would now have to adapt and embrace some “new normal” and it does not come without its own challenges. Nevertheless, it also presents companies with the opportunity to help society redefine what the future would look like.

Related Articles: