Singaporeans will be bracing themselves for a hike in taxes ahead of the Singapore Budget that’s slated to be delivered next Monday on 19 February in Parliament. The Budget – to be delivered by Finance Minister Heng Swee Keat – will outline the government’s financial plans for the rest of the year, which include public spending and taxes, among others.

“Heng Swee Keat (Singapore Finance Minister) was right when he said raising taxes is not a matter of whether, but when,” said Lee Hsien Loong to the Straits Times.

Many are already expecting that the government will raise taxes after Singapore Prime Minister, Lee Hsien Long made the above comment at the People’s Action Party (PAP) convention in November, 2017.

The Prime Minister insisted that the country’s expenditure on healthcare and infrastructure will increase and argued for the need for higher taxes. He pointed out that this will benefit the people of Singapore, "… well before that time comes, we have to plan ahead, explain to Singaporeans what the money is needed for, and how the money we earn and spend will benefit everyone, young and old."

According to data released by the Ministry of Trade and Industry (MTI) this week, the Singapore economy grew 3.6% in 2017 – higher than the forecasted 3.5% - making it the strongest performance in the country since 2014.

The Straits Times reported in January that public spending and infrastructure investments are the main reasons behind the need to increase taxes. For example, government spending on pre-schools will double to SGD1.7 billion by 2022.

Reuters also reported in January 2018 that the aging population of the country is straining the low-tax model Singapore is best known for. Citing an Institute of Policy Studies (IPS) study in their report, it is projected that Singapore will have 91 elder persons for every 100 workers by 2080. This is probably due to the country’s high life expectancy and low fertility rate.

The aging population would further strain the country’s social welfare spending. “As expenditure on social needs rise, given the country’s demographic trajectory, there is however a recognition that tax revenues will have to rise in tandem,” the IPS study mentioned.

According to a news report from Bloomberg this week, Singapore is currently running a deficit on its primary fiscal balance, meaning that Singapore is spending more than the revenue they are taking in.

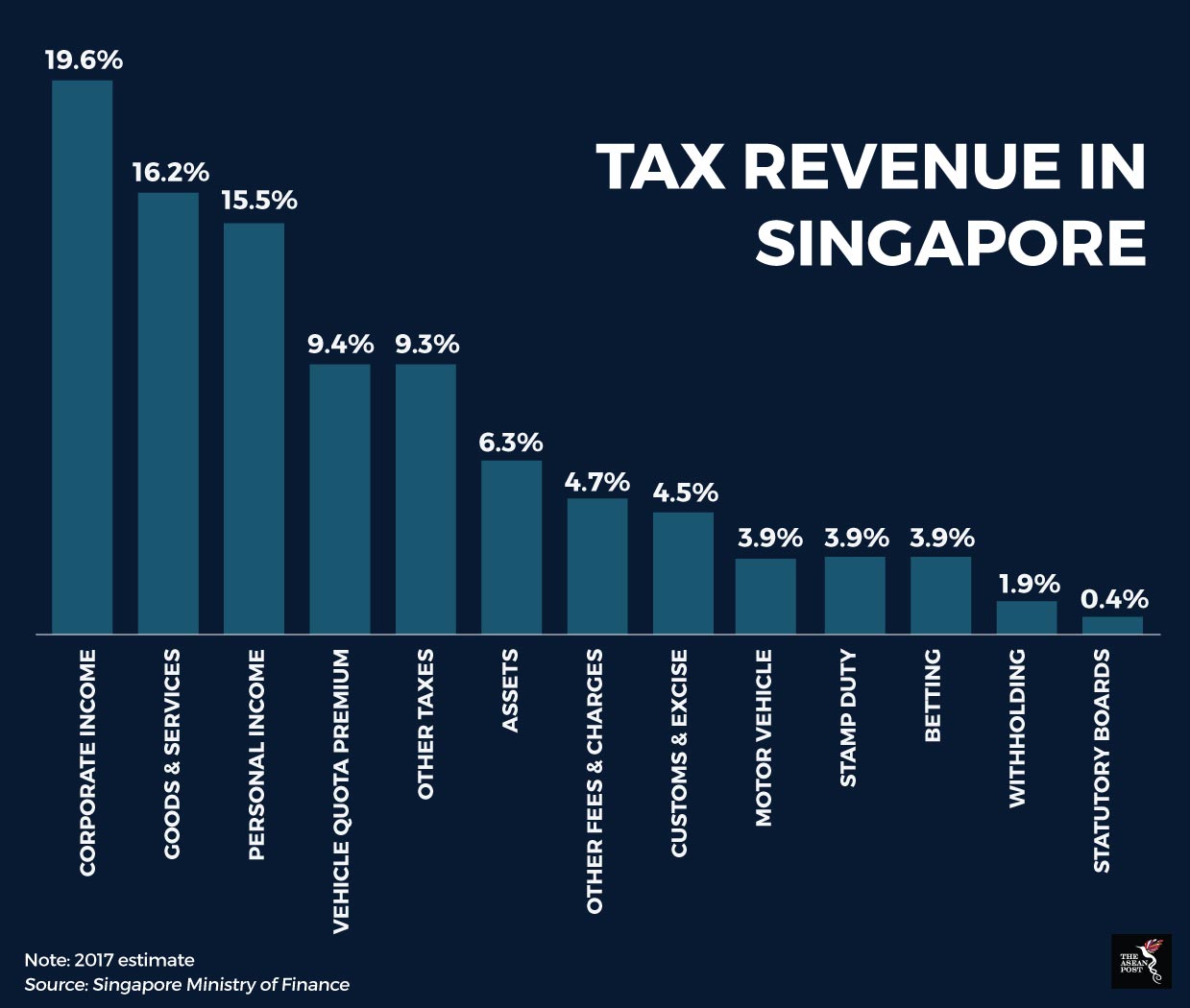

While how the government plans to increase their revenue is relatively unknown until the budget is actually revealed, economists have been speculating that there could be an increase in goods and services tax (GST). An increase in GST this year would be the first increase since 2007. However, a survey of 12 economists done by Bloomberg in January shows that none of them thought that any increase in the tax rate would be above two or three percentage points.

There is also potential that Singapore could explore other taxation routes. Eight out of 10 economists polled by Reuters this month predict that the government will announce a tax on online purchases. At the moment, Singaporeans do not have to pay GST for goods that are shipped from overseas. However, KPMG Singapore is more cautious about the introduction of taxes in e-commerce, advising the government to survey its implementation overseas before adapting it in Singapore.

The Singaporean government can also explore increasing other existing taxes such as corporation tax or income tax. They could also introduce capital gain taxes or inheritance tax which are common in many countries.

However, this seems unlikely, especially after the United States’ recent tax cuts. Singapore’s low taxes and pro-business policies have always been the reason for their economic performance. Singapore currently ranks number two in the world for ease of doing business according to a World Bank report released in June, 2017. It does not seem likely that Singapore will implement these taxes as it could affect their competitiveness in the market.

Singapore is currently at a crossroads as its seeks to increase revenue. If taxes for producers and investors are increased, their competitiveness might drop. However, if the government increases income tax, it will burden consumers, and have a disgruntled population to deal with. The challenge would be to find a balance between the various taxation models to increase productivity and preserve the harmony of the nation.

Recommended stories: