Ever since the financial crisis of 1997 swept Asia, many observers felt that some of the affected countries would never fully recover. Southeast Asian countries were among the victims, with Indonesia and Thailand among the worst hit. The currencies of both these countries were hit hard by speculative attacks which devalued them severely. The International Monetary Fund (IMF) had to intervene and provide a bailout package of up to US$43 billion for both countries.

Fast forward 20 years, and the region has flourished as a collective economy. The 10-member states that make up ASEAN now have a combined gross domestic product (GDP) of US$2.4 trillion, and is jointly the third fastest growing major Asian economy after China and India. The financial crisis that swept the region has proven to be a blessing in disguise, with most countries building strong foundations for economic growth.

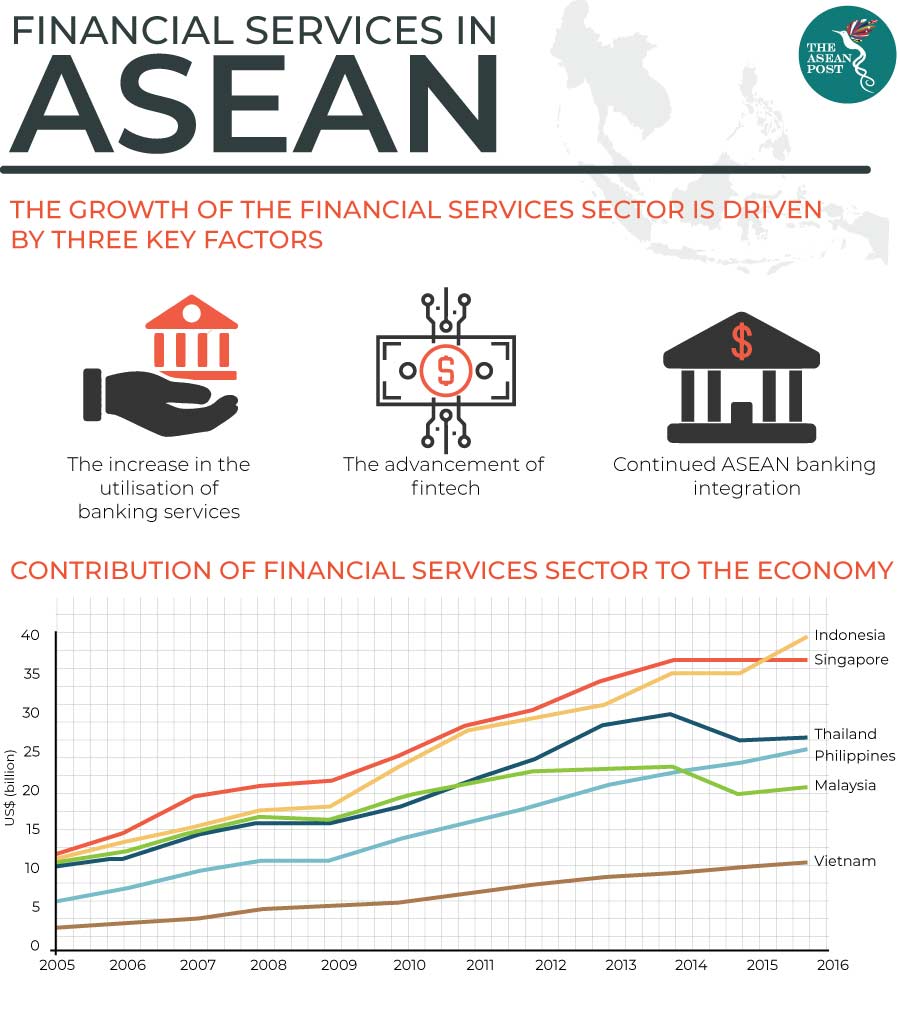

One such driver of growth is the region’s rising financial services sector. Ever since 2005, the financial services sector has grown rapidly. Within 10 years, the sector had contributed more than US$20 billion to the economies of the Philippines, Thailand, Singapore and Indonesia.

While Singapore has always been the paragon of the region’s financial sector, other countries in the region are fast catching up. In 2016, Indonesia leapfrogged Singapore to become the largest financial services market in ASEAN in terms of financial gross value add (GVA).

According to a report by PwC, despite the rise of financial services from 2005 to 2016, the financial services sector is expected to slow down in the coming years. This does not mean there will be no growth, just that the growth of the financial services sector will not be as exponential as previously. PwC predicts that the financial services sector in ASEAN is still expected to outpace that of more mature markets.

The growth of the financial services sector is said to be driven by three key factors – the increase in the utilisation of banking services, the advancement of fintech, and continued ASEAN integration.

As ASEAN’s economy continues to grow, so too has the region’s middle classes. Currently, there are 87 million middle class households in Southeast Asia and the number is expected to reach 116 million by 2020. The rising disposable income for this group of citizens will increase the demand for financial instruments that can facilitate the purchase of services and higher-value products.

Foreseeing the demand for financial services, many fintech firms have begun setting up shop in the region. This, combined with the region’s ever-growing smartphone usage and internet penetration rates, will witness digital banking services experiencing exponential growth.

Challenges

The future may look bright for ASEAN’s financial services sector but there are still some hurdles to be overcome. One major problem is the lack of access to banking, insurance and asset management services. Indonesia, the Philippines, Vietnam, and Cambodia are all still lagging behind in banking penetration compared to Thailand, Malaysia and Singapore. The rise of digital wallets and digital services may help the unbanked populations in these countries, but such services can only do so much. Without proper banking and financial infrastructure in place, access to financial services for these citizens will remain low.

The lack of financial access will create other problems too for the financial services sector. The financial services sector relies largely on non-cash transactions, be it digital or via debit and credit. Since many in the region do not have financial access, this has created a society that still prefers cash as their mode of payment. The PwC report highlighted three key challenges to transitioning from cash to debit or credit – the lack of Point of Sale (POS) penetration, low interoperability, and low payment volumes.

Right now, the region’s financial services sector has all the right ingredients for it to flourish, but there are still major gaps that need to be plugged. However, it is not the responsibility of any one particular entity – such as governments or banks – but for every actor in the ecosystem to play their roles effectively to ensure continued growth.

Related articles: