2018 proved to be a fantastic year for the Vietnamese economy. Figures from the government showed that the socialist state’s gross domestic product (GDP) grew by 7.1 percent year on year in the first six months of 2018 – the fastest growth recorded since 2011. Vietnam’s impressive growth rate is expected to continue this year.

As the Vietnamese economy continues to grow, consumption choices in the country have begun to change. A growing middle class and increased access to the internet has led to a flourishing digital economy. 54 percent of Vietnam’s population is on the internet and this number is expected to grow in the coming years.

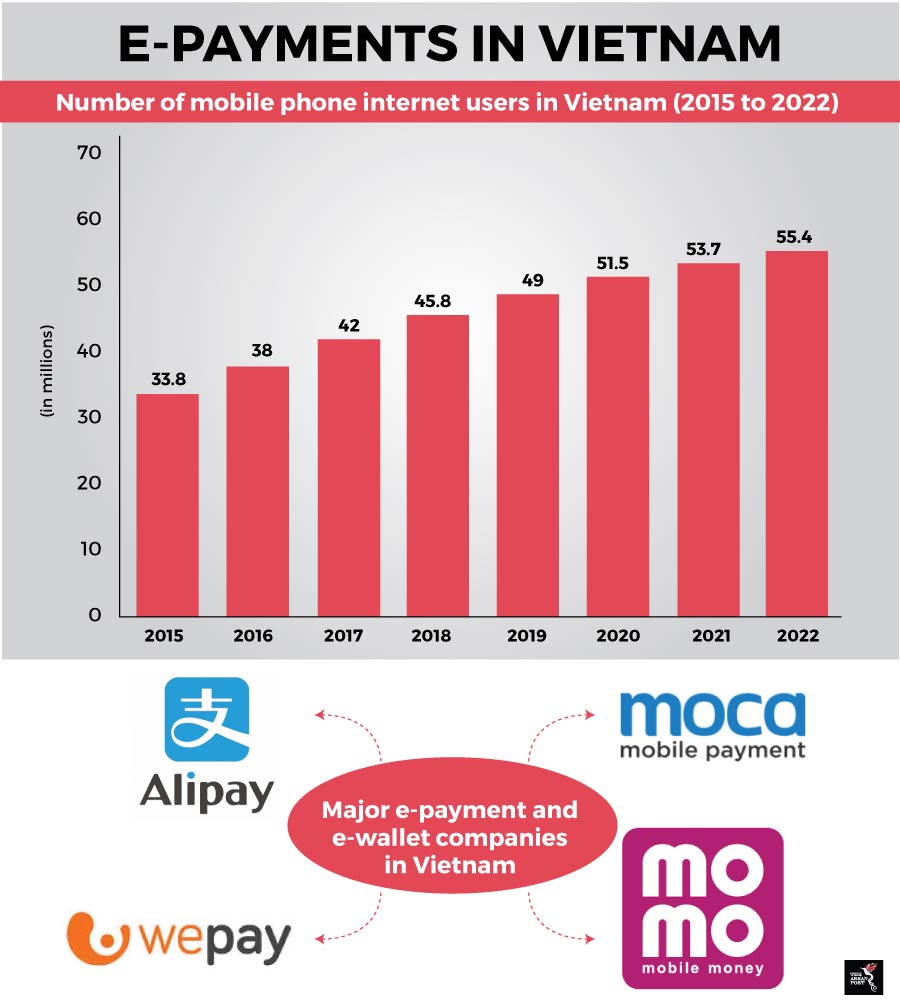

Among the major aspects of a digital economy is cashless online transactions or better known as e-payments. In societies that have a high internet penetration and a growing digital economy, the reliance on cash as a mode of payment is less. Instead, e-payments are usually the preferred choice as they are faster and usually more convenient.

In Vietnam, e-payments are slowly taking off. According to Statista, in 2017, the number of e-payments in the country grew by 22 percent from the previous year and was valued at US$6.1 billion. This figure is forecasted to grow to US$12.3 billion by 2022.

Despite these impressive figures, the number of e-payments in Vietnam is miniscule compared to that of its neighbours. The World Bank revealed that Vietnam currently has the lowest number of non-cash transactions in the region at only 4.9 percent. The figure is much higher in Thailand at almost 60 percent, while in Malaysia it is close to 90 percent.

Sources: Various

Sources: Various

Currently, there are a few big players when it comes to e-payments in Vietnam. Aside from the obvious international ones such as GrabPay and AliPay, local fintech firms are giving them a run for their money.

One of the pioneering Vietnamese start-ups in the e-payment space is Momo. The company helps customers in Vietnam make nationwide cash transfers, pay more than 100 types of bills, recharge mobile phone accounts, settle personal loans, and many more. The company’s payment system is also in partnership with 24 domestic banks and foreign payment networks, including JCB, MasterCard, and Visa. Their rivals include ZaloPay, Vi Viet, and Bankplus and a host of others.

Noticing that Vietnam is lagging behind its neighbours in the e-payment sector and the importance of e-payments in strengthening the digital economy, the government there has taken some swift measures to fix this. Last month, it (the government) announced a resolution that would intensify support for the expansion of cashless transactions.

Local media reported that the resolution instructs the chairs of provincial and municipal People’s Committees to direct all schools, hospitals and suppliers of electricity, water, sanitation, telecommunications and postal companies in urban areas to coordinate with banks and intermediary payment service providers to collect fees and payments for their services using cashless transactions by December 2019.

The State Bank of Vietnam has also been tasked to come up with solutions and methods to encourage the use of e-wallets.

Aside from that, Vietnam has also long offered institutional support for fintech start-ups in the country. In 2016, the government established the National Agency for Technology, Entrepreneurship and Commercialisation Development (NATEC). NATEC is a platform under the Ministry of Science and Technology which aims to provide training, mentorship, business incubation and acceleration and financial aid to new start-ups.

However, focusing on start-ups and urban centres may not be sufficient. The government should also focus on improving access to e-wallets and other fintech services for people living in the more rural parts of Vietnam.

60 percent of the rural population in Vietnam is unbanked and face difficulties in accessing financial services. Giving the rural population access to mobile financial services will not only increase cashless transactions but allow them to gain access to microfinancing and loans as tools to empower them.

A move towards a cashless society should not be seen just as a convenience for consumers. It also represents a step towards becoming a more efficient and empowered society.

Related articles:

E-commerce set to dominate the region in 2019