In December, it was revealed that the government of Thailand had passed a bill that it hoped would ensure more effective tax collection, especially from e-commerce businesses. The new law requires financial institutions to report customer accounts which receive either more than 3,000 deposits and money transfers or more than 400 deposits and money transfers with a total of at least US$61,087 a year to the Revenue Department.

Deputy Finance Minister Wisudhi Srisuphan, who chaired the National Legislative Assembly (NLA) committee vetting the bill, revealed that of the 10.7 million Thais aged between 30 to 39, 8.2 million receive a monthly salary and 520,000 of them were found to have filed individual tax returns. He said 2.4 million people are not in the salary system while 310,000 of them were found to have submitted individual tax returns. Meanwhile, out of the 640,000 juristic persons subject to tax payment, only 420,000 were found to have filed tax returns.

Huge revenue

While the bill has received criticism for its mechanism especially from opposition politicians, taxing e-commerce would make a lot of sense considering the large amount of money being made by the industry in Thailand.

The Electronic Transactions Development Agency’s (ETDA) latest report revealed that the market value of business-to-consumer (B2C) e-commerce in Thailand ranked the highest in Southeast Asia at US$23.3 billion in 2017. It also expects the value of Thailand's e-commerce market to reach US$93.2 billion this year, up 8.5 percent from last year, driven by the continuous growth of social commerce.

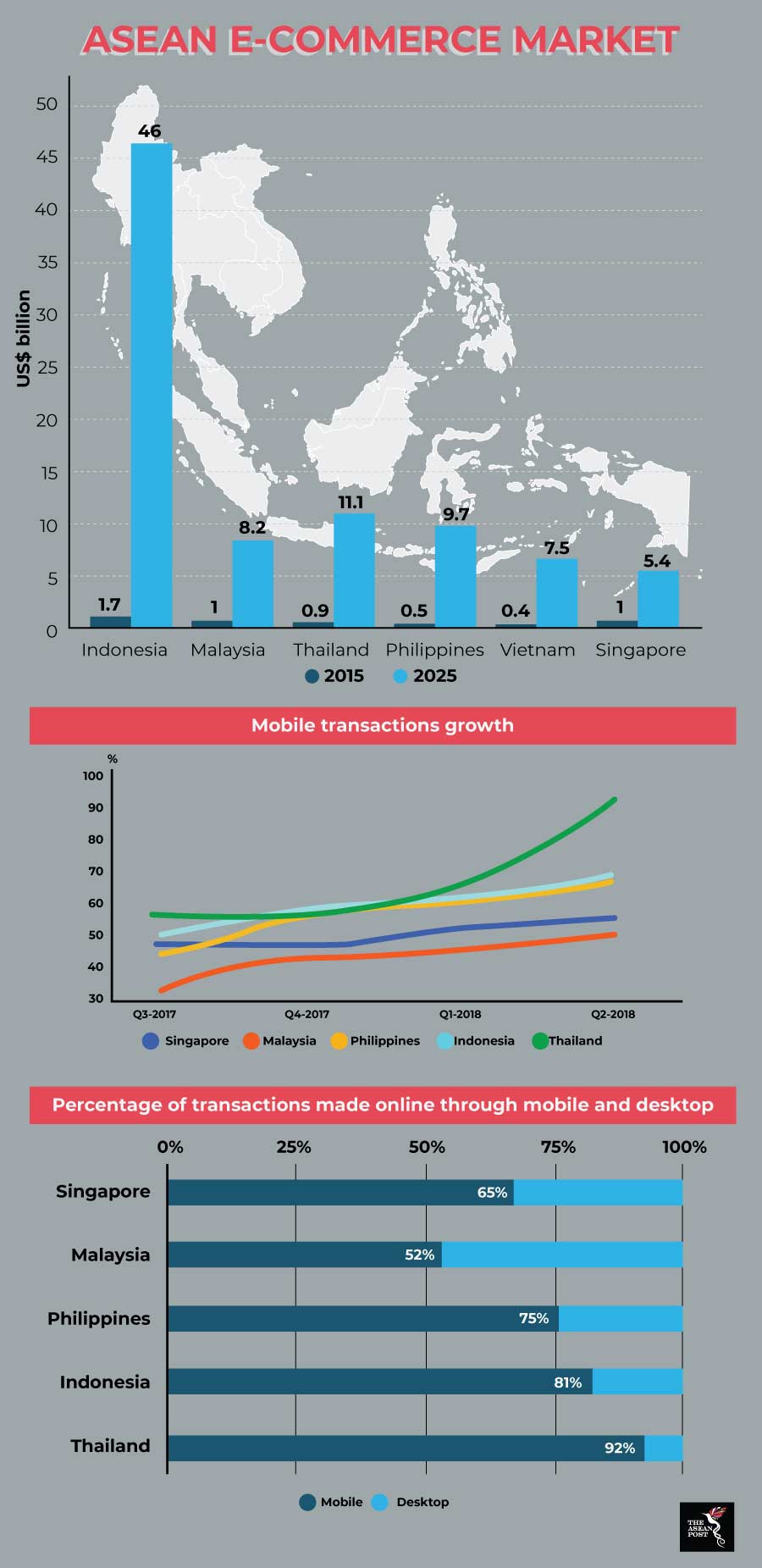

Similarly, a recent study by Google and Temasek predicts that Thailand’s e-commerce market will grow from US$900 million in 2015 to US$11.1 billion by 2025 (at 29 percent of the compound annual growth rate or CAGR). This will make the e-commerce sector in Thailand the second largest in the region after Indonesia.

“Thailand will be the hub for e-commerce and e-payments in the ASEAN Economic Community (AEC)”, said Kulthirath Pakawachkrilers, managing director of Joyfulness Co., an e-commerce specialist.

Google also found that in general, Southeast Asia will be the next major boom market for e-commerce in the Asia-Pacific region. In an interview with local media, Marc Woo, Google’s Country Manager for Malaysia said there were two reasons for this: a growing middle class and rapidly expanding internet access.

Connected Thailand

Utilising a proprietary database containing traffic and transactional data in five key economies in Southeast Asia (Singapore, Malaysia, the Philippines, Indonesia, and Thailand) ShopBack found that Thailand came out tops for mobile transactions growth.

Of the five countries studied, Thais displayed the strongest preference towards making purchases using ShopBack’s mobile app. Meanwhile, Malaysia’s mobile app purchases gained 18 percent over the past four quarters, Singapore’s grew by eight percent, the Philippines by 16 percent, Indonesia gained 20 percent, and Thailand saw a 36 percent jump. ShopBack estimated that by the end of the fourth quarter of 2018, the volume of app orders in Malaysia particularly would have grown beyond 65 percent.

The fact that mobile e-shopping is so popular in Thailand goes to show that Thais aren’t just buying products online, they’re buying products online regardless of where they are. In fact, all they need is just a smartphone. Google and Temasek also found that while on average, consumers in Southeast Asia spend 3.6 hours per day on mobile internet, Thais lead with an average of 4.2 hours spent per day.

Thailand isn’t alone

Thailand is not the only country in ASEAN that intends to put a tax on e-commerce. In order to address taxation issues involving e-commerce, beginning this year, Indonesia requires online merchants to own tax identification numbers. The country hopes that this will boost revenue as well as improve compliance in the fast-growing e-commerce industry.

Among Indonesian e-commerce companies which will be asking sellers for identification numbers are PT Tokopedia and PT Bukalapak.com. This will be the condition they set for sellers who wish to operate on their platforms. Indonesia’s director general of taxes in the Finance Ministry, Robert Pakpahan said these platforms will submit a monthly report of transactions to the government.

“We want to improve tax enforcement but we don’t want to scare start-ups. Instead of the start-ups collecting taxes, their merchants will perform self-assessment on the arrears,” he said.

Failing to take advantage of the large sums of money e-commerce generates would not only be a huge loss of revenue to the government, it would also be unjust especially to the millions of Thais who would be able to benefit from the extra money going into the country’s coffers. Thailand, as an ASEAN member, does not stand alone in realising that a lot of money is being made from e-commerce in the region and that it would be foolish not to capitalise on it.

Related articles: