The adoption of electric vehicles (EV) by Southeast Asian policymakers has rapidly accelerated over the past few months. There is now a race between the bigger players in the region such as Thailand, Malaysia, Singapore and Indonesia to become a regional hub to deploy and manufacture electric vehicles.

Currently, there are four types of EVs globally. The first two to be developed are hybrid electric vehicles (HEVs) and plug-in hybrid electric vehicles (PHEVs) with two respective systems, electricity-petrol and electricity-diesel. Battery electric vehicles (BEVs) was then later developed, which is fuelled purely by electricity. The most recent development in the EV space is known as the fuel-cell electric vehicle (FCVs).

Electric vehicles in Southeast Asia

The Malaysian government has envisioned that by 2030, it will have 100,000 electric cars on the road, along with 2,000 electric buses and 125,000 charging stations in the country, according to a Bernama report. Energy, Green Technology and Water minister, Datuk Seri Maximus Ongkili said that the EV target is part of the country’s National Green Technology Master Plan and the Electric Mobility Blueprint (EMB).

“With that as the target, the government’s transport sector has to start developing the Green Technology Sector more aggressively. Public awareness is also crucial to produce a landscape of low carbon mobility in Malaysia. Therefore, consumers have to be convinced that electric vehicles are an option which is comparable with the existing vehicles they have now,” he added.

Singapore has already made headway in deploying EVs. The electric car-sharing model that is currently available in Singapore through BlueSG, was launched on the island state in December 2017. It has successfully accumulated 5,000 rentals for its 80 cars so far. The model was implemented in the hope of providing cleaner commuting options for Singaporeans instead of having to buy their own cars.

In Indonesia, the government is only currently encouraging businesses to develop EVs in order to create more environmentally-friendly and clean transportation. According to The Jakarta Post in 2017, the Transportation Ministry’s expert for technology and environment affairs, Prasetyo Buditjahjono, said that the market share for electric cars in the archipelagic nation is set to reach 20 percent in 2025.

The Thai story

The Thai government has been working hard to make the country a hub for the manufacturing of electric vehicles after its success in becoming a base for production pickup trucks and eco-friendly cars.

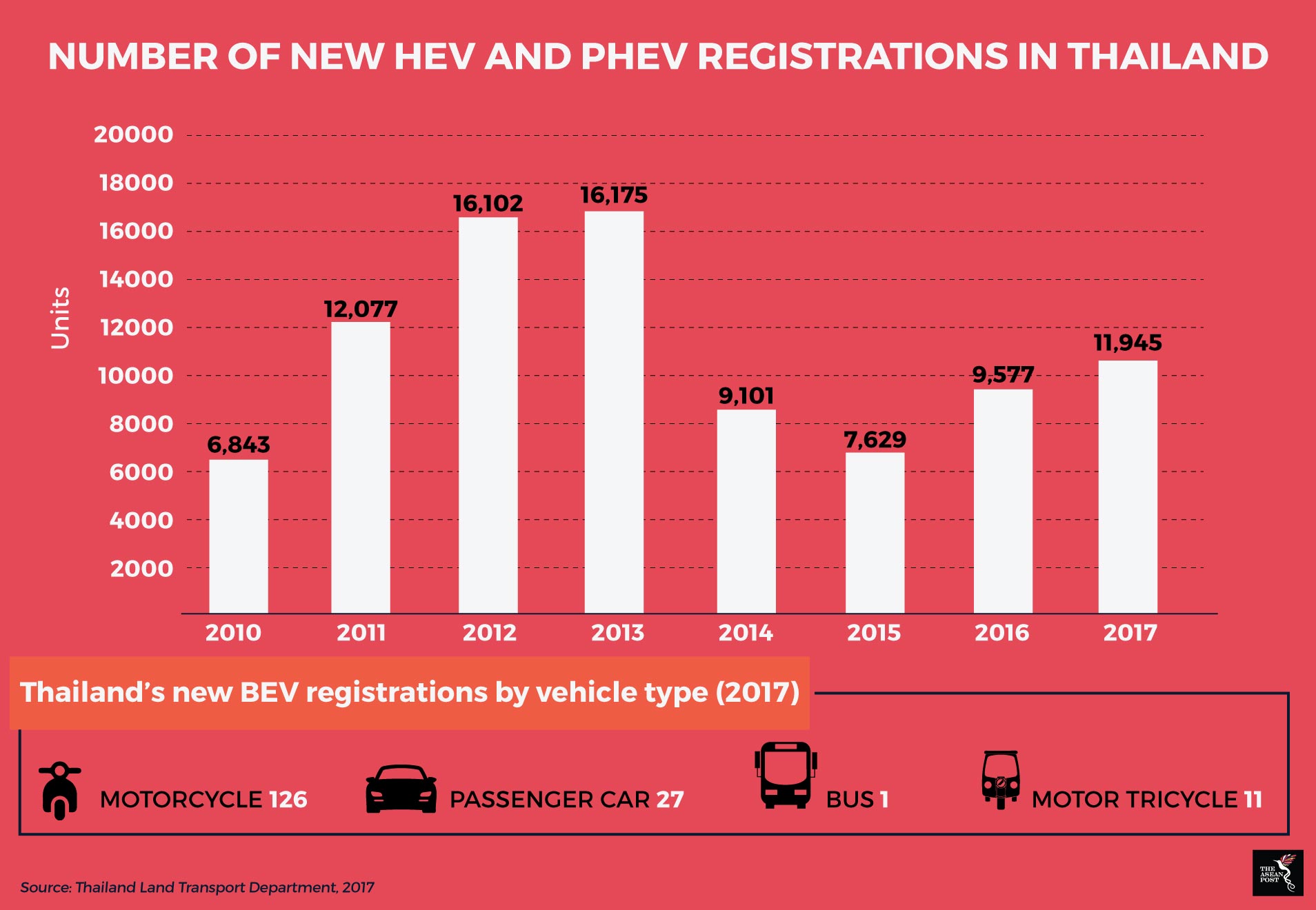

In 2014, Thailand had only 60,000 electric hybrid passenger cars and just 8,000 battery electric motorcycles that were registered. In 2017, this number has grown according to The Land Transport Department. The department reports a total of 102,308 cars (HEV and PHEV varieties) and 1,394 BEV cars.

The use of electric vehicles is part of a bigger plan by the government which is the Thailand Alternative Energy Development Plan 2012-2021 in which its committee had drafted a ‘Electric Vehicle Promotion Plan for Thailand’.

The Thai cabinet approved the plan in March 2015 and requested the Board of Investment (BOI) to further explore the potential of Thailand as a production hub for EVs. As a result, the Electric Vehicle Association of Thailand (EVAT) was formed by knowledge institutes and private organizations.

According to the Bangkok Post, Yossapong Laoonual, president of EVAT, said that given the market size, the EV take-up rate in the country is still lacking. He also said that the Energy Policy and Planning Office (Eppo) has given 42.53 million baht to government agencies, state-owned enterprises and private firms to construct public charging stations.

"I predict that the private sector will jump into expanding the number of charging outlets. Both charging operators and car assemblers will become trendsetters, they will define what the EV market will look like in the future,” he added.

In order to further expand the electric vehicle market in the country, the Thai government also plans to introduce non-tax privileges and deductions for manufacturers and buyers of EVs.

Although there may still be uncertainties in how to generate maximised demand in the domestic market, others in the region should follow suit in powering the electric vehicle market in their respective countries. The deployment and use of electric vehicles will not only cut costs for consumers but will also bring about long-term environmental benefits.

Recommended stories: