Thailand’s start-up growth comes hot on the heels of strong start-up progress in Singapore and Indonesia. For the Thai government, driving Thailand towards digitisation under the Thailand 4.0 initiative is key. Foreign investors too are looking in on the potential in the region.

By the end of 2017, Thai start-ups in e-commerce alone had received the most investments, with 29 funding rounds, followed by fintech (12 funding rounds), logistics, and e-payments (11 funding rounds each), according to the Techsauce Q4 2017 Investor Guide: Thailand Tech Start-up Report.

Government initiatives and funding

Thai government initiatives have been key to the incubation and the provision of a conducive environment for start-up growth in Thailand through the provision of funding, mentorship and tax relief.

In 2016, the Thai government launched a US$570 million venture fund for Thai start-ups, while its Digital Economy Fund allocated US$285 million for technology start-up ventures. More recently, its Ministry of Science and Technology also designated Bangkok as a start-up hub and will set up three new incubators in Thung Khru and Pathumwan districts to provide support to start-ups focusing on developing science and technology-related solutions.

Since February 2017, the Thai government has also provided for up to five years’ corporate tax exemptions for start-ups in 10 promoted business categories including digital services, while venture capital firms can be exempted for up to eight years. Digital services encompass fintech, medtech and agritech, for example.

In particular, fintech start-ups also received an additional boost when the Bank of Thailand in 2016 launched a regulatory sandbox for start-ups relating to payment, fund transfers and loans. Regulatory sandboxes were also launched by the Securities and Exchange Commission (SEC) and Office of the Insurance Committee (OIC) to allow start-ups freedom to experiment with algorithm-based trading and insurtech.

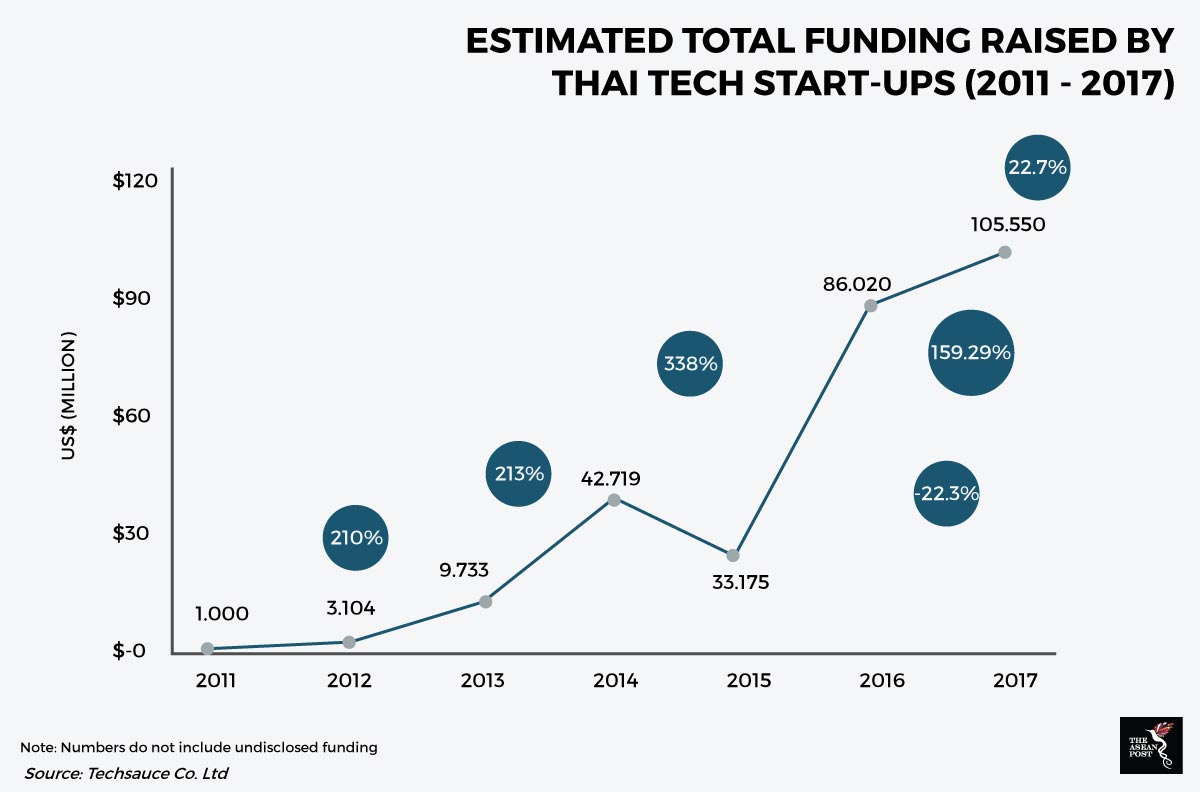

These are some of the examples of initiatives that have created a conducive environment responsible for Thailand’s start-up growth; from just three funded start-ups in 2012 to 75 funded start-ups in 2016.

Within Thailand, growth has occurred because companies have invested in tech start-ups relevant to their respective businesses. One example, Sansiri Plc, a real estate developer, is investing 1.5 billion baht through its tech investment arm Siri Ventures Co. between 2018 and 2020 to build property technology solutions.

Regional interest & expansion

Regional venture capital firms have been taking notice of Thai start-ups’ progress and are investing there. Indonesia’s Kejora Ventures, for one, opened an office in Bangkok in 2017 in addition to offices in Indonesia, Philippines and Singapore. It then invested US$1.5 million into Thai fintech start-up, MoneyTable.

That same year, Singapore’s trade agency, IE Singapore, also signed two memoranda of understanding with Thai social enterprise C asean and Hubba, a co-working space, to develop the two countries’ tech ecosystems in tandem.

In 2017, Thai start-ups as a whole received US$120 million in funding, with e-commerce platforms Zilingo, aCommerce and Pomelo accounting for over US$101 million alone.

This year, Thai tech start-ups could see a more competitive market, with even higher investments in AI, machine learning and health tech, according to Sompoat Chansomboon, managing director of DTAC Accelerate. Meanwhile, untapped opportunities still lie in aviation, agriculture, and tourism, among other sectors. For agriculture, the potential lies in novel farming systems, supply chain tech and agricultural technology, according to the AgTech Investing Report 2016.

While growth trends for Thai tech start-ups is positive overall, the regional context within which it will be played out is also important to consider. Thailand could take advantage of a growing e-commerce sector in Southeast Asia, which incorporates e-logistics, e-payments and fintech within its framework. The e-commerce market segment in Southeast Asia is expected to hit US$88 million by 2025, according to a 2016 joint report by Google and Temasek.

Indeed, Thai start-ups that have reached a certain stage must also start looking at regional expansion, stressed Jeffrey Paine, a founding partner of Golden Gates Venture in 2017. A larger market, he said, would be more attractive to investors. Meanwhile, expanding their market base would entail the development of solutions for regional challenges, according to Edgar Hardless, head of Singtel Innov8 Ventures Pte Ltd.

By expanding regionally, Thai start-ups, however, would be facing-off with the competition from foreign players as well.

“My suggestion for Thai startups is that they had better find the right partners who can help them grow internationally. Don’t compete with them alone,” Chansomboon added.

Recommended stories: