Alibaba and Tencent are two household names in the global technology sphere. For a long time now, these two Chinese giants have slugged it out on their home turf in a struggle to achieve dominance in the growing Chinese internet consumer market. Having had a duopoly advantage thanks to China’s “Great Firewall,” these two, battle-hardened titans of the tech industry have sought to extend their businesses beyond their borders.

A key battleground for their continued efforts to reign supreme in the global technology sector is Southeast Asia.

Southeast Asia goldrush

The goldrush for Southeast Asia is down to a combination of factors including a sizeable market, increasing broadband and smartphone penetration and a growing number of localised start-ups offering a myriad of services ranging from e-commerce to ride-hailing and medical technology.

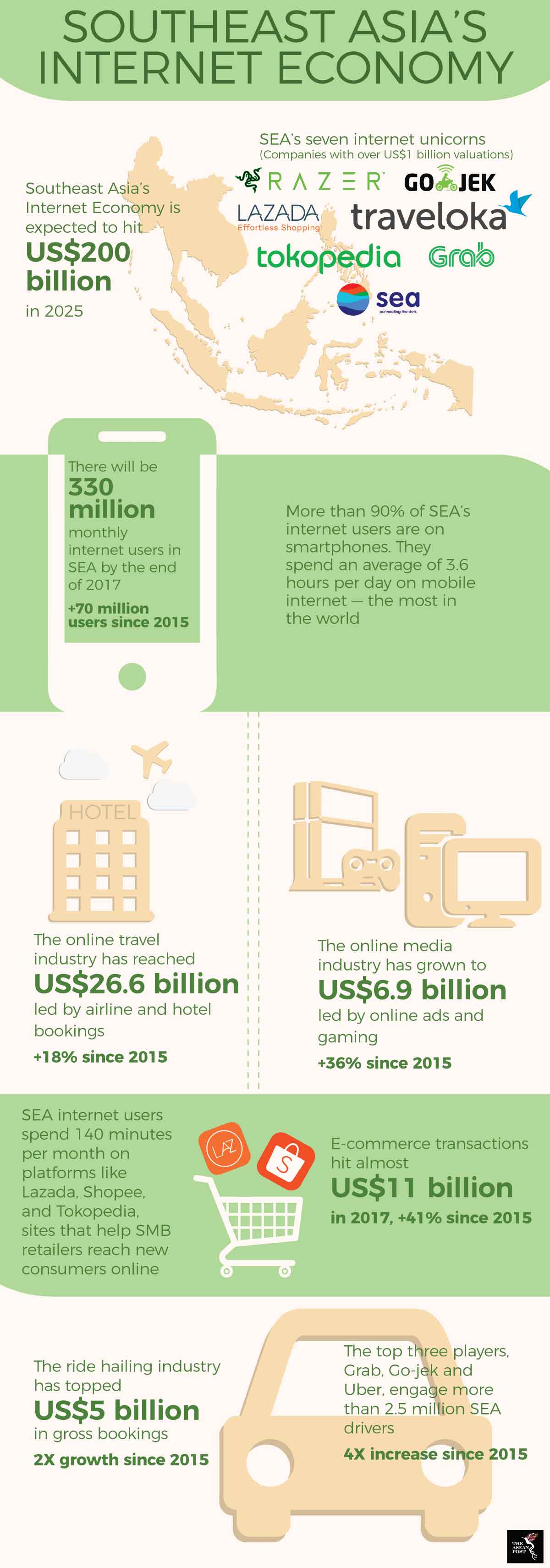

Home to over 640 million citizens, the Southeast Asian region encompassing the 10-member Association of Southeast Asian Nations (ASEAN) is the world’s third largest region for internet users. Its internet economy is set to quadruple in value from US$50 billion in 2017 to US$200 billion in 2025. The three largest markets there, Indonesia (261.1 million), the Philippines (103.3 million) and Vietnam (92.7 million) make up 70 percent of the ASEAN citizenry.

With a growing internet penetration rate, it is no surprise then, that there are approximately 7,000 start-ups in the region offering a myriad of technology-based services including e-commerce. Indonesia has recently emerged as a hotbed of start-up activity, having already produced five unicorns - all of which have the immense Indonesian market to thank for their success.

Increasing smartphone usage has also been a key driver for e-commerce as the region’s primary e-commerce web traffic comes from that nifty handheld device. According to a report by iPrice Group, mobile e-commerce has grown 19 percent on average and in 2017 accounted for 72 percent of overall e-commerce traffic. Indonesia ranks highest among ASEAN states with an 87 percent share of mobile traffic.

Battleground Southeast Asia

Alibaba and Tencent have been engaged in a free for all in Southeast Asia – each eating up local e-commerce start-ups and increasing their equity in existing ones.

Source: Google-Temasek Study 2017

Alibaba has mainly cemented its grip on the e-commerce market with investments in Lazada and its Indonesian rival, Tokopedia. It has also extended its influence via joint ventures and technical cooperation with the governments of Thailand and Malaysia leading to the creation of digital free trade zones and e-commerce hubs in these countries.

On the other hand, Tencent has invested mainly in gaming, payments, ride-sharing and ride-hailing among others. It has become the largest shareholder of Sea and is keen on raising Indonesian app Go-Jek’s profile from a primarily e-hailing app to a “super app” like WeChat.

Another factor that could alter the competition space is the departure of Alibaba’s co-founder and executive chairman, Jack Ma in one year’s time. Arguably the face of the company, Ma’s exit is part of a broader succession plan which would see the ascension of Daniel Zhang, an 11-year veteran of the company to the reins of leadership at Alibaba.

Alibaba shares have been on a slump over the past few months which could suggest a need for a renewed vision to propel the company forward. Zhang professes a preference for brick and mortar stores which could very well complement the existing online dominance of the company.

Alibaba and Tencent also have to contend with the dark clouds gathering over the Chinese economy. The looming trade war with the United States (US) and the yuan’s continued depreciation against the dollar are causes for concern which could throw the long-term growth of both companies into question.

Nevertheless, the perseverant nature of both tech giants may see them through potential hard times in the near term. Expansion to Southeast Asia could be the remedy to declining income in mainland China. Southeast Asia as one of the fastest growing regions in the world and home to an economy worth over US$2.5 billion – roughly 20 percent the size of China’s – may just be the next battleground for these two tech titans as they continue to make their mark on the world stage.

Related articles:

Alibaba-Thailand partnership to open up lucrative business opportunities