Labour rights violations in ASEAN are among the negative effects of an increase in production due to the ongoing United States (US)-China trade war which has resulted in a shift of some production from China to this part of the world. While the region is embarking on the Fourth Industrial Revolution, numerous industries in ASEAN still rely on labour-intensive factories. Unable or unwilling to invest in technological advances that would automate production and ease workloads, many factories across Southeast Asia are filled with migrant workers who have appeared in the news for all the wrong reasons.

Featuring more prominently in the headlines though is the US-China trade war which has seen the US and China impose tariffs on each other’s goods worth US$360 billion last year, slowing global growth and creating uncertainty in markets worldwide. With US President Donald Trump yesterday saying that the US would raise tariffs on US$200 billion worth of Chinese goods from 10 percent to 25 percent this week as he was unhappy about the pace of the trade talks, the Chinese delegation which is scheduled to arrive in Washington on Wednesday for the latest round of discussions may now cancel their trip, creating more concerns about the standoff.

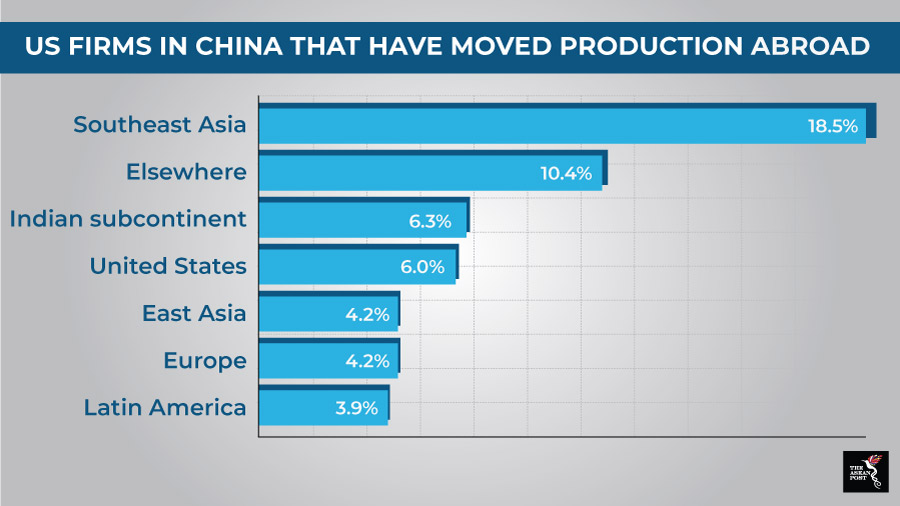

China is officially looking to move away from low-level manufacturing towards innovation and consumption, and while the world’s second largest economy will retain much of its manufacturing footprint in the coming years, brands will continue to diversify their supply chains and seek sourcing and production in new (cheaper) markets.

Shifting production

Supply chain auditing firm QIMA conducted a year end survey of more than 100 businesses across the globe last year, finding that as many as three-quarters had already started sourcing suppliers in new countries as a result of tariff increases – many citing ASEAN countries as alternative markets. Most companies already sourced ASEAN countries in the textile and apparel industry, but rising tariffs have accelerated this process as the uncertainty is making ASEAN a more attractive destination.

ASEAN is also an attractive destination for migrant workers, and the influx has led to a wide range of labour rights violations being documented – with numerous stories of overworked workers being underpaid and mistreated. According to the International Labour Organisation (ILO), among the most common labour rights violations include unsafe workplaces, excessive working hours, lack of overtime pay, wage theft and lack of freedom of association.

Speaking exclusively to The ASEAN Post, QIMA’s CEO and founder Sébastien Breteau said that there has been an increase in workers’ rights violations in ASEAN countries that have seen shifts in production from China.

“In many of the countries that employ migrant labour, such as Malaysia and Thailand, there has been an uptick in instances of modern slavery that coincides with the sourcing shift,” said Breteau. “Generally speaking, most of the factories in ASEAN countries score lower in ethical compliance than those in China and have suffered more cases of critical non-compliance. As the number of audits being performed increases in the region, the issue is being amplified,” he added.

However, ethical compliance issues were prevalent in ASEAN even before the shift and many of the recent high-profile modern slavery cases such as in Top Glove (Malaysia) and Bangkok Rubber (Thailand) were identified before the trade war. Breteau noted that factory compliance remains an issue across markets. Vietnam and Indonesia, for example, saw their average factory scores deteriorate by -5.1 percent and -3.2 percent year-on-year, respectively according to QIMA’s Q1 2019 data.

With key consumer markets such as the US, UK, Australia and the Netherlands proactively passing legislation which holds companies accountable for cases of modern slavery within their supply chain, ASEAN will have to adjust accordingly to ensure their industries maintain ethical production standards and eliminate labour rights violations.

While the increase in Western buyers switching to new sourcing countries will have a positive impact on worker’s rights in the long term, in the short term, the shift does have some negative implications – as rapid growth often does.

“If you look back at China 20 years ago in regard to worker’s rights, you saw similar issues to what you are seeing in ASEAN. Thanks to the pressure to meet global trade requirements, working conditions in China have improved dramatically and we expect to see similar improvement in ASEAN countries over time,” said Breteau.

Related articles:

Can Industry 4.0 revolutionise manufacturing?