Health and medical tourism is becoming more prominent and is seen as a growing trend worldwide, according to Global Wellness Institute, a non-profit organisation for the wellness industry. The World Health Organisation (WHO) defines medical tourism as when “…medical tourists elect to travel across international borders to receive some form of medical treatment.” These treatments, as noted by the Centre for Entrepreneur Development and Research (CEDAR) include a full-range of medical services with the most common treatments being cosmetic surgery, elective surgery and fertility treatment.

Based on a report in 2016 by US-based Patients Beyond Borders, an organisation which monitors trends in medical tourism globally, it is estimated that the medical tourism sub-sector globally is expanding at a rate of more than 25% annually and is valued at over US$55 billion with a market of more than 11 million consumers. From these figures, nearly a third comprise of medical tourists travelling to Southeast Asia for treatment.

Asia, in general, continues to be the top medical destination for medical tourism. This is because Asian medical destinations continue to offer more options and better medical procedures and aftercare than most other medical destinations, as indicated in the ‘Asia Medical Tourism Market and Forecast To 2022’ report.

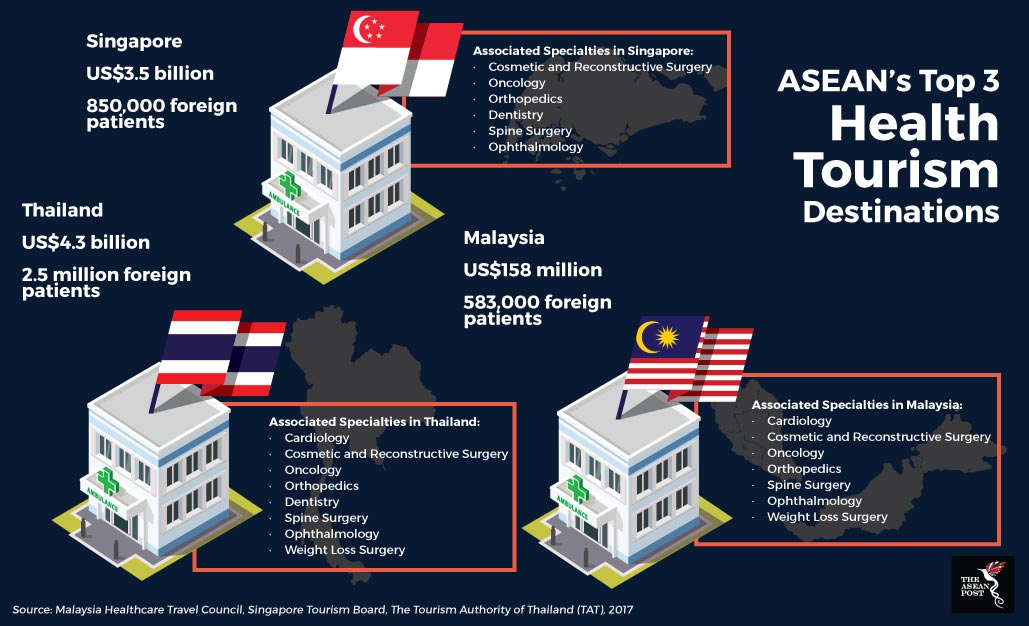

The report also stated that among the top five nations in Asia for medical tourism, three of them are Southeast Asian countries – namely Thailand, Singapore and Malaysia.

Major players in Southeast Asia

Treatments offered in these countries range from cosmetic surgery and fertility treatments right up to cardiac and cancer therapy. While patients come from a variety of countries outside the region, such as China, the United Kingdom and the Middle East amongst others, it is important to note that the majority of patients that travel to these three countries for medical care come from within the Southeast Asian region itself.

According to the CIMB ASEAN Research Institute, ‘AEC Blueprint Analysis 2017’ report, Indonesia has been the largest contributor to the region’s overall medical tourists sector, spending around US$11.5 billion annually, mostly in Malaysia. This is due to the fact that the quality of Indonesia’s medical treatment and technology are lagging behind that of Malaysia, Singapore and Thailand.

What drives Southeast Asians to Thailand, Malaysia and Singapore for medical treatment?

Some factors that prompt people from the region to travel for healthcare include lower costs, with cheaper flights and accommodation, shorter waiting times and accessibility to treatments that are unavailable in their home countries. Apart from that, cultural similarity also plays a key role in the decision-making process of medical tourists.

Patients Beyond Borders reported in 2016 that annually more than 80% of Malaysia’s cross-border patients are from Indonesia. This influx of Indonesian patients to Malaysia could be due to the short travel distance between both countries and of course, ease of communication with no apparent language barriers.

What do they have to offer?

Thailand

Medical tourism in Thailand is the biggest compared to the other two countries in the region due to the low-cost yet high quality medical treatments offered by hospitals in the country. Medical tourists usually select Thailand as their preferred choice for medical tourism for procedures like cosmetic or plastic surgeries, dental, ophthalmology and eye surgeries. Among the leading private hospitals in Thailand are the Bumrungrad International Hospital, Bangkok Hospital Group and Samitivej Hospital.

Malaysia

Over the years, Malaysia has managed to continue improving its healthcare infrastructure and quality while keeping prices low. It is said that Malaysia is on par with India for both, the value-seeking patient as well as the upper-class patient seeking all kinds of specialties in the region. Patients Beyond Borders also states, in a 2017 update, that compared to neighbouring island-state Singapore, Malaysia offers excellent facilities and care, but with prices about 30-50% percent lower. Private hospitals in Malaysia that accommodate foreign patients include Beacon Hospital, Sime Darby Subang Jaya Medical Center, and KPJ Damansara Specialist Hospital among others.

Singapore

Through regional and international promotion, Singapore welcomes around 550,000 medical tourists annually, mostly from nearby Indonesia and the Philippines, according to Patients Beyond Borders in a 2017 update. Some popular healthcare institutions include Johns Hopkins Singapore International Medical Center, Raffles Medical Group and Mount Elizabeth Novena Hospital. However, due to its thriving economy and higher currency, Singapore has become one of Asia’s more expensive medical travel stops compared to other destinations in the region.

Maintaining the status quo

It is highly unlikely that the upsurge in health tourism in Southeast Asia will recede anytime soon. With the continuous growth experienced by healthcare industry, these three countries will see an upsurge in foreign patients from within and out of the region.

Countries in the region could also tap into different branches of health tourism such as Halal Medical Tourism, as there is a growing demand for it throughout the region, according to CEDAR. Apart from that, dental tourism should also be another option as more and more people look outside their home countries for better and cheaper dental treatment.

If healthcare infrastructure and facilities continue to be developed and more attractive packages and services offered, then, Southeast Asia is set to remain a popular destination for health tourists looking for a balance between good value and excellent medical services for their hard-earned money.

Recommended stories: