ASEAN citizens are not unfamiliar with digital payments.

In a survey by Visa, around 64 percent of consumers in Southeast Asia are confident of going cashless for a full day, highlighting the region’s strong drive towards digital payments. Moreover, the 2019 World Payments Report shows that the value of non-cash transactions in Asia is projected to grow from US$96.2 billion in 2017 to US$352.8 billion by 2022, a meteoric rise of over 266 percent.

Contactless payments allow people to make payments by tapping their payment cards or phones on point of sales (POS) terminals instead of swiping or inserting their cards. QR (quick response) codes are two-dimensional bar codes which can carry purchase transaction information – allowing merchants to receive payments from customers when scanned.

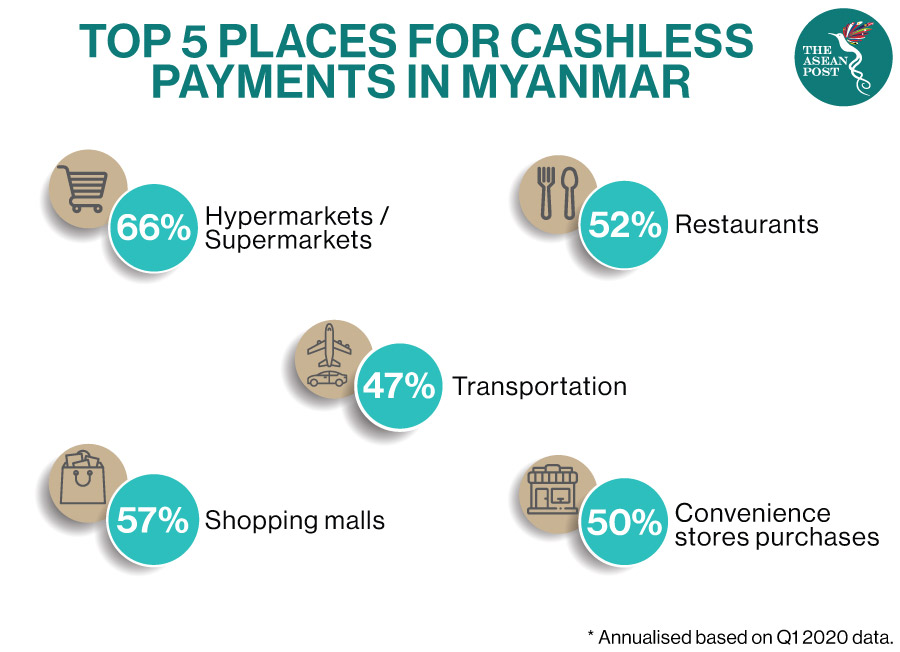

Surveying 504 people in Myanmar across Yangon, Pathein, Mandalay and Magway in September 2018, Visa found that up to 60 percent of consumers use cashless payments to settle payments in hypermarkets and supermarkets.

Nevertheless, awareness of cashless payment systems in Myanmar is still rather low compared to other ASEAN member states.

Obstacles

There are several challenges in getting Myanmar to go cashless.

Digital payment solutions rely on electricity and the internet, and the lack of reliable electricity supply in rural areas is probably the biggest obstacle in converting people from cash to digital.

Another problem in Myanmar is a lack of training around such technology.

“Even in Yangon and Mandalay, where people are familiar with technology, some employees do not know how to accept payments by phone or card and sometimes ask for cash instead because the internet is down,” Nyein Chan Soe Win, CEO and co-founder of e-commerce and ride hailing platform Get Myanmar told local media.

Although the Ministry of Transport and Communications revealed that there were over 56.8 million mobile subscribers in the country during the fiscal year 2017-2018, relatively few people have bank accounts in Myanmar.

Payment consultants Mercator Advisory Group estimates that 74 percent of Myanmar’s citizens do not have a bank account and only five percent have debit cards – making it hard to develop an e-payment system based on mobile phones.

However, the interest is definitely there.

Visa noted how 64 percent of people it surveyed in five urban areas in Myanmar expressed interest in opening a bank account and utilising modern payment systems.

Time Is Now

Last February, a digital payment channel was set up in Myanmar using India’s RuPay card scheme. Local media reported that interest in Myanmar’s digital payment system has further increased since the announcement. It was also reported in mid-March that the Central Bank of Myanmar is implementing a national standard for digital payments using QR code.

“Every country has to move on with this standard, and Myanmar will participate as well. Currently, Myanmar has payment platforms such as Wave Money and OK Dollar, and mobile wallets are offered by banks. But we still need to do some work to supervise or test these payment platforms, and we need a national-level campaign to raise consumer awareness,” said U Zaw Lin Htut, chief executive officer of the Myanmar Payment Union (MPU).

U Zaw Lin Htut also believes that 2020 will see digital payments grow in Myanmar. He told local media that banks will try to promote digital payments via their mobile apps and cards, and will also try to make transactions via mobile devices instead of traditional bank branches.

“We need more time to transition to cashless payments, but the movement will gain strength by the end of this year,” he added.

The government is also pro-actively trying to encourage more use of cashless payment methods and to introduce such solutions into the daily lives of its citizens.

U Aung Soe, director of Myanmar’s Export Promotion Department warned that the country’s economy will be left behind if digital settlements and e-payment systems do not improve as they are playing an increasingly key role in facilitating trade, especially among the country’s youth.

With people urged to stay home amid the coronavirus crisis and avoiding public areas, many traditional payment providers will perhaps fast-track their digital innovation efforts. The change in customer behaviour during the pandemic will likely boost the demand for digital banking services.

Related Articles: