ASEAN is the world’s third most populous economy and is projected to become the fourth largest economy by 2030. By then, domestic consumption, which powers roughly around 60 percent of ASEAN’s gross domestic product (GDP) today, is expected to double to US$4 trillion. The population too will reach 723 million from the current 648 million people.

As a bloc, ASEAN is facing uncertainty from disruptions caused by the current COVID-19 pandemic. The Asian Development Bank (ADB) has adjusted Southeast Asian growth projections down to one percent for 2020. Nevertheless, annual growth is projected to rebound to five percent next year.

Over the next 10 years, ASEAN will see an additional 140 million consumers, representing 16 percent of the world’s new consumers, according to the World Economic Forum (WEF) in a recent report published in June titled, “Future of Consumption in Fast-Growth Consumer Markets: ASEAN”.

Rapid digital adoption in ASEAN will also continue, said the WEF, spurred by digital native consumers. There will be nearly 575 million internet users in the region by 2030. As digitalisation reaches communities in rural areas, it will remove barriers that inhibit small business growth and enable the delivery of basic services such as healthcare and financial services.

In the same WEF report, the organisation highlights the region’s present and future outlook on consumption. The report builds on in-depth consumer surveys conducted across 1,740 households in 22 cities and towns across Southeast Asia, as well as over 35 in-depth interviews with private and public-sector leaders.

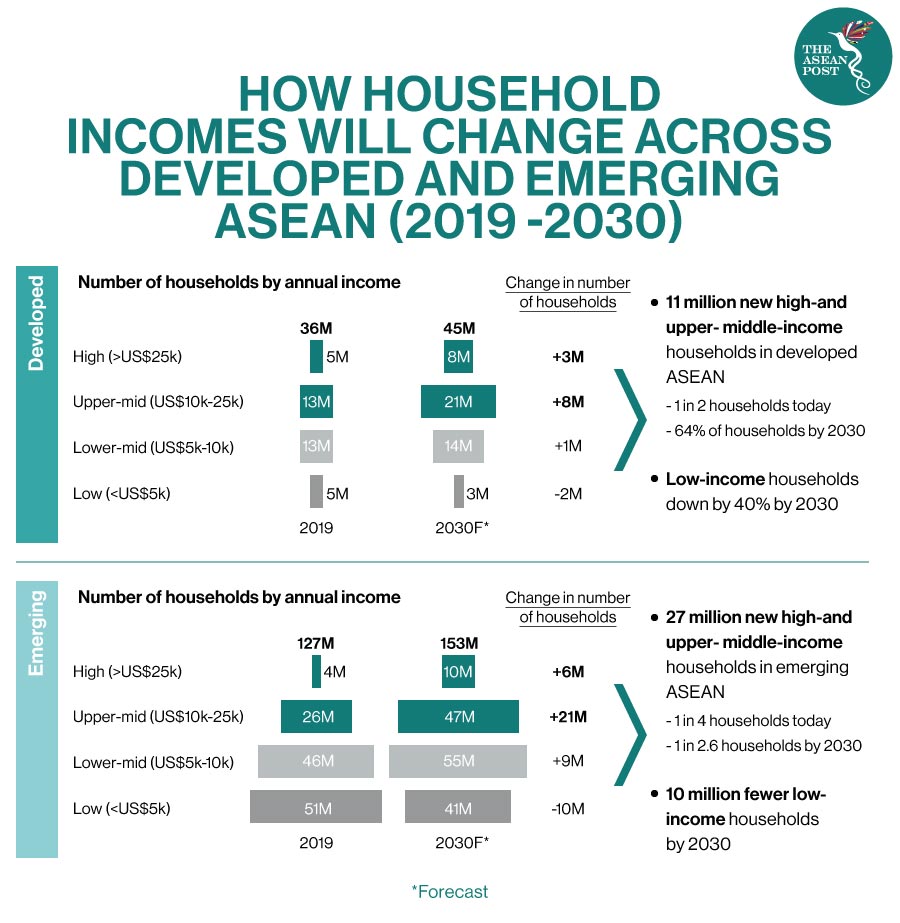

Developed And Emerging ASEAN

There is a wide disparity across all 10 ASEAN member states in regard to levels and speed of development. In the aforementioned WEF report, the 10 countries are classified into three different groups.

At one end of the spectrum are the three developed nations: Singapore, Malaysia and Thailand. On the other end are the four economies of Cambodia, Myanmar, Lao and Brunei.

In the middle lie the three emerging economies of Indonesia, the Philippines and Vietnam. This is where 70 percent of ASEAN’s population live, contributing to more than 50 percent of the region’s GDP.

According to the WEF, the growth of these countries and ASEAN will be propelled by four “mega-forces” which include favourable demographics, rising income levels, geopolitical shifts and digital tailwinds.

Drivers Of Future Consumption

As stated earlier, the WEF identified four forces that will drive the future of consumption in the region. Firstly, is favourable demographics. A young, tech-savvy population, entering the workforce and migrating to big and small cities, will spur consumption in emerging ASEAN members – Indonesia, Vietnam and the Philippines.

The WEF states that emerging ASEAN will be the engine of growth over the next decade, driving 98 percent of the increase in the working population and contributing 70 to 80 percent of the new consumer population.

ASEAN’s working-age population will increase by 40 million by 2030, with Indonesia contributing more than half of that group. This is in comparison to China’s working-age population which is expected to reduce to 30 million in the same period.

“This explosion of the working middle-class will materially boost productivity and spending to the point that the GDP growth rate of emerging ASEAN is expected to overtake China,” stated the WEF.

In addition, labour costs in emerging ASEAN are also lower than in many other parts of Asia. Vietnam’s labour costs are said to be 50 percent that of China’s. The combination of an expanding workforce, low labour costs and the potential of productivity gains is highly attractive for investment and growth.

Secondly is rising income levels. According to the WEF report, income levels will grow annually by six to eight percent in emerging ASEAN, creating economies powered by the middle class. The highest increase in income is expected to happen in Vietnam.

Further fuelling consumption will be a significant increase in the number of high- and upper-middle income households in emerging ASEAN, which will nearly double from 30 million in 2019 to 57 million in 2030.

Shifts in global geopolitics and local regulations will also open the door for foreign direct investments (FDI) and other opportunities. Nevertheless, it will also create challenges such as rising protectionism. The WEF foresees ASEAN becoming a popular destination for FDI as multinationals rebalance supply chains to diversify geopolitical risk and make the most of low-cost labour.

The last force that will drive ASEAN’s growth is unsurprisingly, digital adoption.

“ASEAN’s digital economy will become truly inclusive, as consumers adopt digital, investors fund innovative digital businesses and governments support key digital transformation programs,” stated the WEF.

As a market bloc, ASEAN is about to take a tremendous leap forward in socio-economic progress.

Related Articles: