The 2016 We Are Social’s special report on digital opportunities in Southeast Asia revealed that over half of Southeast Asia’s population is on the internet. This number is significant because it indicates that half the population have the opportunity to immerse themselves in the digital economy and participate in buying and selling things online, using digital wallets and so on. The increase in more affordable internet services and the establishment of the digital economy in the region has had far reaching effects. One of which is how traditional shopping is now viewed by consumers in general.

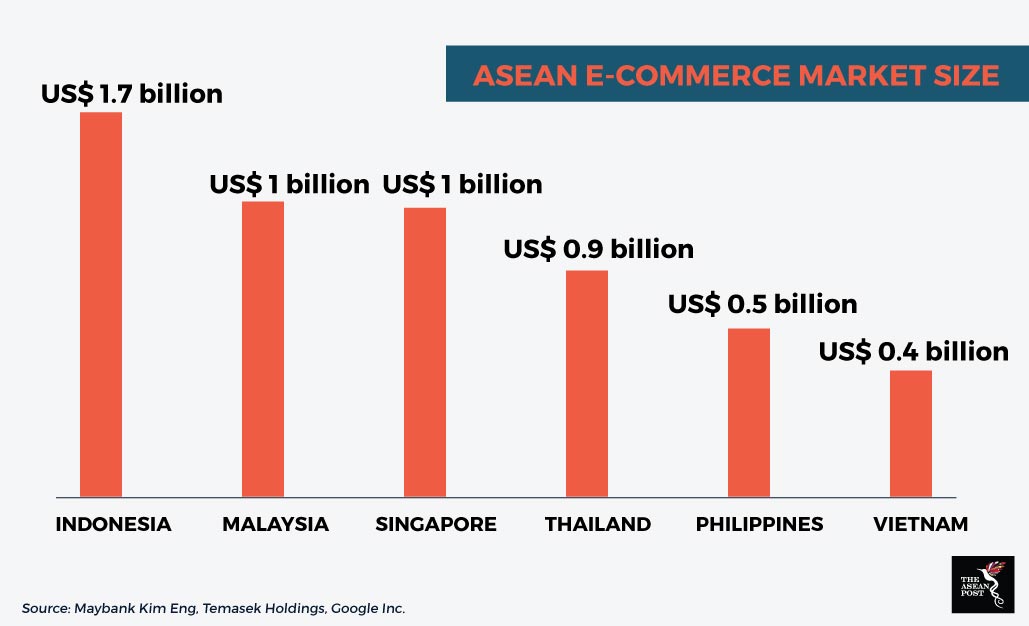

In a report released in 2017 by Google in collaboration with Singapore’s Temasek, it was found that Southeast Asians spend the most time online compared to anyone else on the planet, with most of the time online being spent on social media websites. We Are Social’s report also shows that social media penetration in the region is 47%, which is higher than the global average.

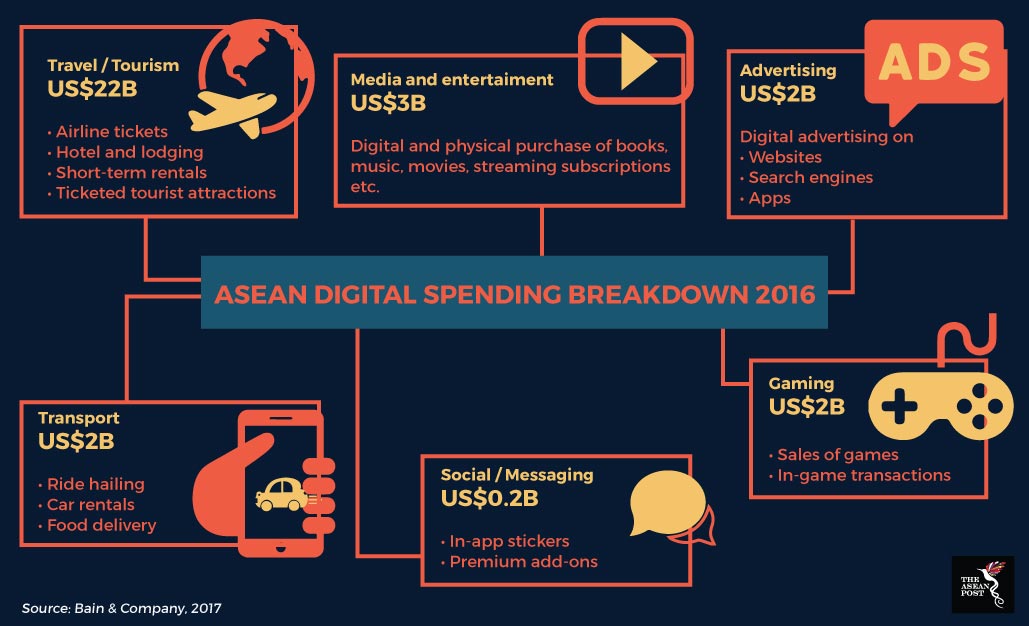

Given how big social media is here, the popularity of “social commerce” in the region isn’t surprising. Social commerce is basically buying and selling items on social media websites such as Facebook and Instagram. Bain & Co’s report in 2016 showed that 150 million people in the region shop through social media – accounting for 30 million online sales transactions in Southeast Asia that year. The number of consumers participating in social commerce proves that this phenomenon is unique to the region. Market-research firm Global Web Index’s data from 20 shows that only 7 percent of the United States’ 287 million internet users partake in shopping on social media.

The growth of social commerce in Southeast Asia has seen a number of small businesses flourish. Due to requiring very little operational costs – as you only need an account and goods to sell – social commerce in Southeast Asia has flourished and is still overshadowing larger websites such as Lazada, 11Street and so on. PwC data from 2016 shows that social commerce alone accounts for 51% of online shopping in the region.

Aside from that, the internet is also paving the way for more cashless transactions in the region. The proliferation of fintech startups in the region have seen the mushrooming of e-wallet and e-payment systems such as Cambodia’s PiPay, Singapore’s PayNow and Thailand’s PromptPay among others. E-hailing companies have also introduced their own digital payments platforms with Grab introducing Grab Pay and Go-Jek with Go-Jek Pay. The Nikkei Asian Review reported in January that Alibaba and Tencent are also trying to penetrate the e-wallet market in Southeast Asia. At the end of last year, Tencent’s WeChat Pay obtained approval for a Malaysian electronic payment license that allows users to sync the WeChat app with their debit bank accounts. Tencent’s integration of social media and e-payment could be a masterstroke in the region considering how popular social media and online shopping is here.

Google and Temasek’s report also revealed that Southeast Asia’s digital economy is only going to grow bigger and bigger. It is expected that the digital economy will grow more than six-fold, to a staggering US$200 billion economy by 2025.

As the digital economy grows, the traditional retail landscape will definitely change. In the near future, shopping malls could become less popular as more and more youths opt for online shopping rather than going to a brick and mortar establishment. We could also see a hybrid of online and retail shopping emerge here in the region - similar to the Amazon Go store introduced in the United States. Amazon Go’s store in Seattle is partially automated and customers are able to purchase products without going through a cashier but by using their amazon account instead.

Despite all this, don’t expect malls or the traditional retail experience to go anytime soon. As everyone is aware, the region thrives on its vibrant street markets – and as far as we can tell, they won’t be integrating e-wallet systems anytime soon.

Recommended stories: