As China and the United States (US) engage in a trade war, the ripples of the battle is felt throughout the world. Both the countries are the two largest economies in the world with a combined gross domestic product (GDP) of almost US$32 trillion, a third of the global GDP. Considering how entangled both countries are in the global economy, it is no surprise that the trade war has left many governments worrying about the potential impact on their respective countries.

Currently, the two countries have imposed tariffs covering US$360 billion of goods between them. The trade war is expected to disrupt global trade routes and uproot the global supply chain. Experts predict the trade war could push production to other locations, which could be more expensive thus pushing up prices and cutting efficiency. This in turn could would increase the price of end products, which could add to inflation and affect the monetary policy in markets. Not only that, global trade flows are also forecasted to slow in the short term as the trade war could dampen investor confidence.

Source: Various

Source: Various

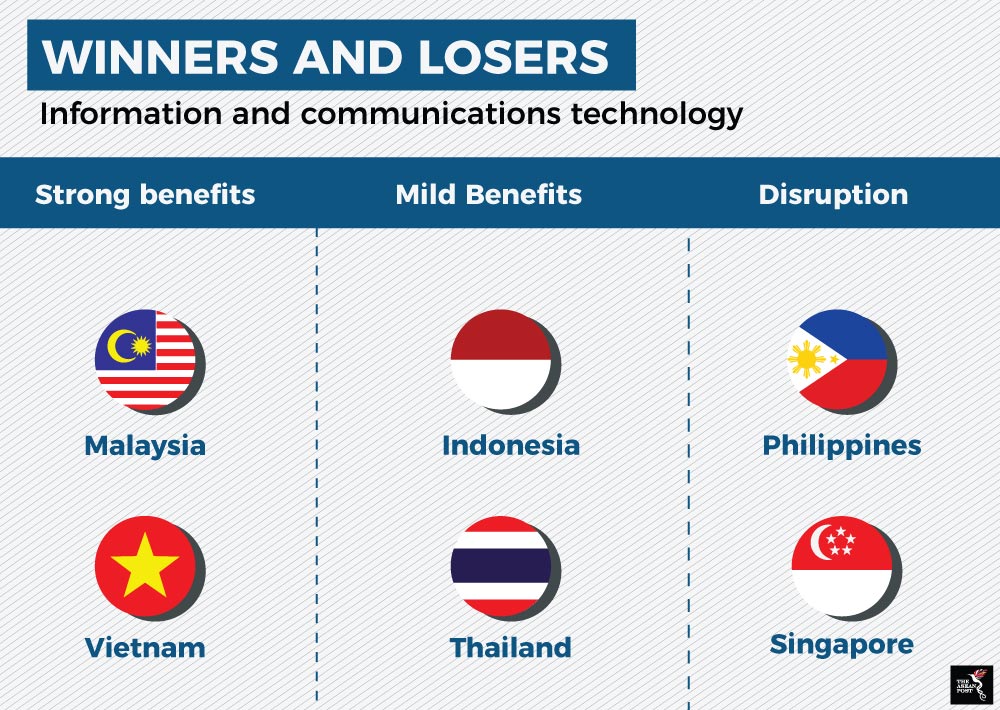

The potential impact of the trade war is clear on the overall economy is clear. However, some countries may feel the impact more than others. According to a report by the Economist Intelligence Unit (EIU), there are a number of countries that stand to benefit from the resulting supply chain shifts in Asia, particularly in the information and communications technology (ICT) industry. Chinese imports of ICT products – which is the biggest category of US imports from China – are among the biggest targets of US tariffs. It is expected that the tariffs on China could cost consumers up to US$3.2 billion for tech products.

The report highlights that the disruption will be felt primarily among the member countries of the Association of South-east Asian Nations (ASEAN). “Multinational companies have already been shifting their export-manufacturing operations away from China and into South-east Asia for much of the past decade. The trade war will accelerate that trend,” said Nick Marro, an analyst with the EIU.

Source: The Economist Intelligence Unit

Source: The Economist Intelligence Unit

It is noted that Vietnam and Malaysia will be among the countries that will benefit most from the US-China trade war. This is because major electronics companies will refocus its manufacturing efforts elsewhere to avoid facing US tariffs. For example, Dell, Sony and Panasonic already have existing plants in Malaysia, while Samsung and Intel also have operations in Vietnam. These existing operations allow the companies to redeploy investment and production relatively smoothly as opposed to having to relocate somewhere new.

Aside from that, it is forecasted that Thailand and Indonesia could gain some benefit from the trade war too. The EIU noted that Thailand had the best potential as it is already doing impressive numbers in terms of exporting electronics. Last year, Thailand exported electronics worth around US$35.6 bilion in 2017.

Several economic policies by the Thai government could also encourage foreign electronic companies to establish a presence in the country. For example, Thailand are undergoing a transformation into Industry 4.0 which the government has dubbed “Thailand 4.0”, which could boost electronics manufacturing in the country. The country is also building the Eastern Economic Corridor special economic zone which could attract electronics companies to set up shop there.

Conversely, countries such as the Philippines could see some disruption from the tariffs slapped on China. The Philippines’ exports to China forms about 16.9 percent of its total shipments as part of the value chain, many of which are electronics.

Some mild disruption in the ICT market is also expected in Singapore – along with Japan, Taiwan and South Korea. This is because China is a major destination for intermediate and final ICT goods from Singapore. However, how much disruption this will cause is hard to tell as the EIU points out, Singapore tends to produce high-end ICT components that are not easily replaceable through import substitution.

However, the shifts in the global supply chain does not happen overnight. Companies may have to rethink internal investment strategies, figure out local regulatory requirements and even find local partners. The EIU says that it may take up to two to three years for the full effects of the trade war to be felt. In the meantime, Southeast Asian countries should take up this opportunity to open its economy to attract companies who are looking to insulate themselves from US tariffs.

Related articles: