The launch of the Myanma Tourism Bank (MTB) earlier this year is the latest initiative by the Myanmar government to spur development in its growing tourism sector.

Offering low interest loans to Myanmar’s tourism players, the bank started operations at its headquarters in Yangon on 6 May – with offices in the capital Nay Pyi Taw and Mandalay among those in the bank’s ambitious plan for a network of 10 branches by the end of 2019.

Boasting a multitude of religious landmarks, luxury resorts and sandy beaches, Myanmar is fast gaining a reputation as an attractive tourist destination and drew in 3.55 million visitors last year.

With 7,800 tour guides and 2,500 local tour companies, the majority of which are small and medium-sized enterprises (SMEs), the introduction of the MTB will go a long way in providing access to credit for Myanmar’s tourism stakeholders.

Economic engine

Not only will this diversify the country’s affordable tourism offerings, loans catering specifically to the tourism sector will also increase the participation of local players in developing the tourism market.

The majority of investments in Myanmar’s tourism sector comes from Singapore, which accounts for more than 60 percent of the US$4.4 billion in foreign investment in hotels and commercial complexes according to Myanmar’s Ministry of Hotel and Tourism.

While investment in travel and tourism lags behind real estate development, transport and communications in Myanmar, it still contributed US$4.9 billion – or 6.6 percent of gross domestic product (GDP) – to the country’s economy in 2017 according to the World Travel & Tourism Council (WTTC).

Combined with positive policy developments such as visas on arrival and visa-free entry, it becomes obvious that the government there is trying its best to draw up support for the industry.

“The government now understands the importance of the sector and sees tourism as one of the major motors of the economy in the coming years,” U Win Aung, chairman of tourism group Amata Holding, told Oxford Business Group.

Budget friendly

Last August, State Counsellor Aung San Suu Kyi called for further development of transport infrastructure, more low-budget accommodation and further diversification of activities and dining options for tourists – and it is in these areas that Myanmar’s tourism players can expect to utilise capital from the MTB.

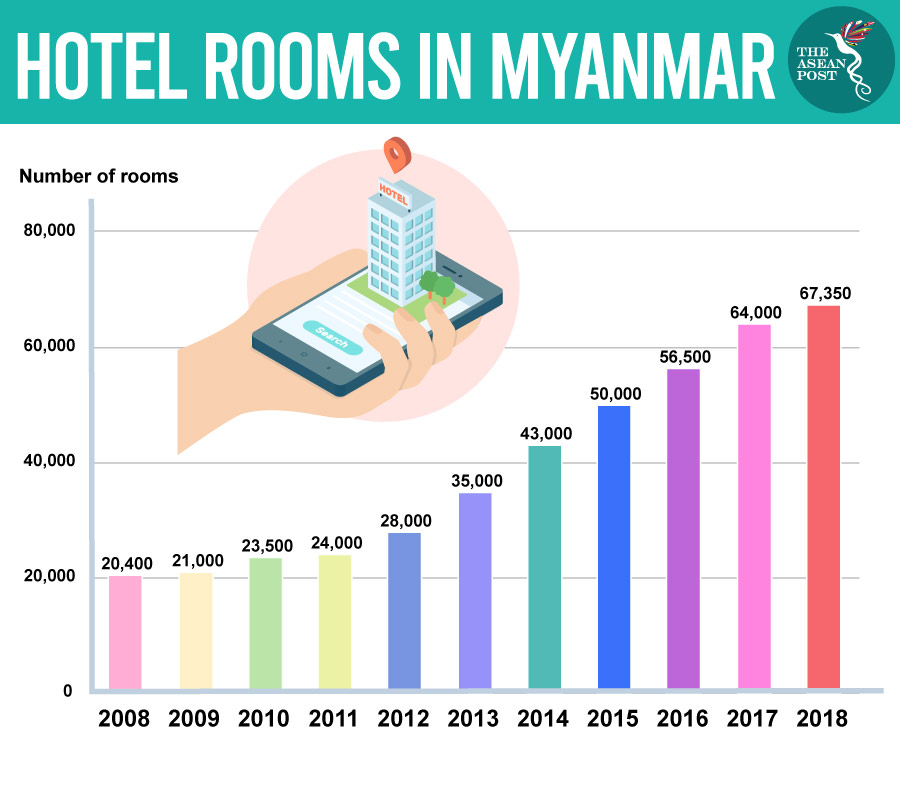

The majority of new hotels and room additions have been for 4 and 5-star hotels, and the credit that MTB offers is sure to motivate local stakeholders to heed Suu Kyi’s call to create more affordable accommodation – especially with the drop in Western tourists.

While the number of Western tourist arrivals has declined due to the negative international media coverage of the Rohingya crisis in Rakhine state, Asian tourist arrivals have made up for that fall in numbers.

Total tourist arrivals in the first six months of the year stood at 2.14 million, a 24 percent year-on-year increase according to the Ministry of Hotels and Tourism. The current numbers put the country on track for its strongest year since 2015, when it attracted a record 4.6 million visitors.

As expected, Chinese tourists have been the biggest drivers of growth – with 320,882 arrivals in the first six months of 2019 – a staggering 140 percent increase year-on-year.

Financial inclusion

Apart from providing access to credit, the MTB will also help bring more people into the formal banking sector.

The MTB is one of five sector-specific banks granted a banking license by the Central Bank of Myanmar (CBM) in 2017 to support the development of their respective industries, with Myanmar media reporting the others as the Mineral Development Bank, Glory Farmer Development Bank, Mandalay Farmer Development Bank and Shwe Nann Saw Bank.

The concept of providing banking services for specific sectors is a rarity in other countries, but in Myanmar, it marks a relaxation of policies by the CBM and offers financing options for the vast majority of the country’s unbanked population.

Noting that just 30 percent of the population had formal access to a financial product in 2013, the United Nations Capital Development Fund (UNCDF) has implemented financial inclusion programs to raise that number to 40 percent by 2020.

The emergence of the MTB and other policy reforms provides Myanmar’s tourism sector with the opportunity to play a bigger role in the nation’s development and helps to shed some of the negative stereotypes about the country.

Related articles:

Can Myanmar attract more tourists?