Growth prospects for six major Southeast Asian insurance markets – Singapore, Thailand, Malaysia, Indonesia, Vietnam and the Philippines – remain robust undergirded by sturdy socioeconomic fundamentals according to a recent report by Moody’s Investors Service. Nevertheless, pace and quality of this growth will vary according to geographies.

The report highlighted that governments of the Association of Southeast Asian Nations (ASEAN) are well aware of widening protection gaps and have initiated policies towards addressing these concerns. Besides that, there are more economic incentives particularly for medical and retirement coverage which has opened up a plethora of opportunities for commercial insurers.

Insurance sector in ASEAN

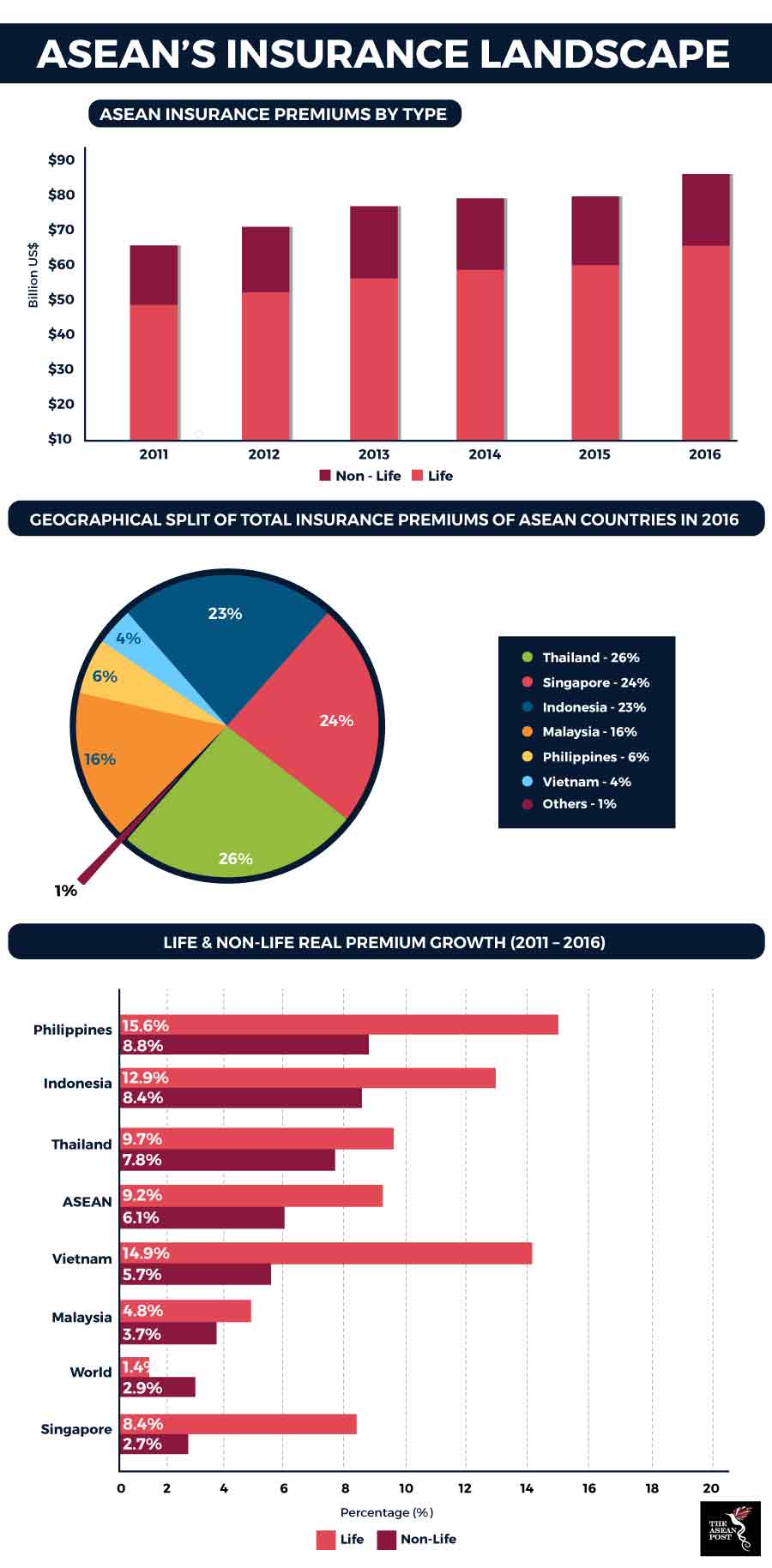

In 2016, insurance penetration in ASEAN member states stood at 3.4 percent which is nearly half of the global average at six percent. However, this number is slated to rise as ASEAN economies continue to grow.

According to a 2017 report endorsed by the ASEAN Insurance Council, the life insurance business represents the lion share of total premiums in the region at 73 percent – compared to the global share of 55 percent. Nevertheless, ASEAN’s life insurance penetration which sits at 2.4 percent, still lags behind the global average of 3.5 percent.

The market for life insurance in ASEAN, however, has been growing. Between 2011 and 2016, it expanded by 9.2 percent per annum, significantly higher than the region’s average economic growth.

For non-life insurance premiums, the gap is much wider, accounting for only one percent of the gross domestic product (GDP) compared to the global average of 2.8 percent. Nevertheless, this gap is fast narrowing as the non-life insurance market in ASEAN outpaced regional GDP growth by one percent between 2011 and 2016 (6.1 percent versus 5.1 percent).

Source: Various sources.

Growing demand

The need for insurance within the region is underpinned by several factors.

According to Moody’s, rising levels of prosperity will improve long term demand for life insurance. Thailand and Malaysia have seen an increase in premium growth for critical illnesses and medical products. Singapore’s ageing working population is also driving growth in retirement annuity policies.

Besides that, the booming insurance technology (insurtech) sector is likely to disrupt existing insurance markets and make insurance more freely available throughout various segments of society. However, progress in this area is still relatively slow.

The ASEAN region is also a disaster-prone area, hence, there is a need for disaster risk financing which can help ASEAN member states become more financially resilient against natural disasters as part of their broader disaster risk management agendas. According to the World Bank, every year, on average, the region suffers damage upwards of US$4.4 billion, a consequence of natural hazards, and this figure is only slated to increase as the years go by.

In the Philippines, greater exposure to natural disasters like typhoons have fuelled demand for catastrophic loss coverage. As such, there is an urgent need for ASEAN members to develop adequate disaster financing strategies to lessen the fiscal burden that natural disasters can have on governments.

Another area to look at is insurance for long-term infrastructure programs. Indonesia have seen an uptick in the demand for property and fire insurance. Whereas in Vietnam, sustained economic development and increasing awareness of risk management are leading drivers for premium growth.

Financial services firm, DBS predicts that the infrastructure investment gap within the region will reach US$3 trillion between 2016 and 2020. Current bank and capital market finance won’t be able to fund what’s needed to meet the sprawling infrastructure ambitions of ASEAN member states. Hence, long term investors like insurance companies can step in and become a useful cog in the region’s financial architecture.

Among other things, they would be able to provide long-term predictable funding to the private and public sectors. The EU-ASEAN Business Council suggests five key areas to look at vis-à-vis promoting long term investments by insurance companies – inclusive regulations for infrastructure investment; capital markets development; support for green financing; action to expand blended finance and a pipeline of bankable projects.

The robust outlook for the insurance industry in the region is welcome news amid increasing protectionist undertones and shifting geopolitical tectonics. This growth will hugely benefit ASEAN governments and all their citizens.

Related articles:

Insuring farmers for food security

Singapore’s new financing plan key to long-term infrastructure