United States (US) President Donald Trump fulfilled one of his election promises by getting rid of the North American Free Trade Agreement (NAFTA) and replaced it with the US-Mexico-Canada Agreement (USMCA) signed on 30 September. The trade deal is notable by the absence of “free trade” in its name and a clause that keeps China from striking separate deals with Canada and Mexico.

Dubbed NAFTA 2.0, the USMCA introduces new policies and requirements on labour and environmental standards, intellectual property protections and digital trade, among others.

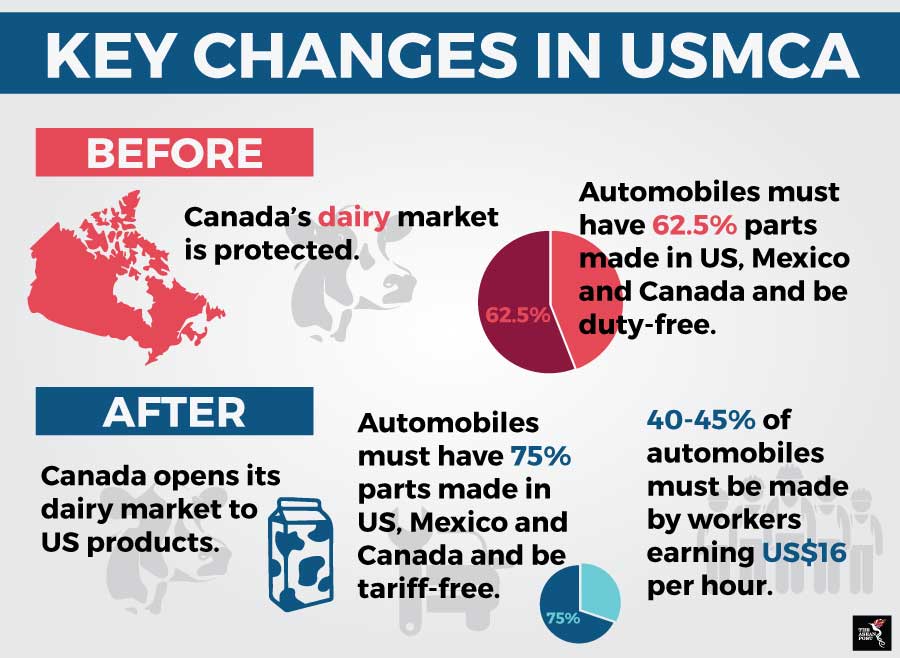

The US automobile industry stands to benefit: cars must have 75 percent of their components made in the US, Mexico or Canada to enjoy zero tariffs. The previous agreement specified 62.5 percent. That means parts for automobiles must be sourced from North America to qualify for zero tariffs.

The USMCA also stipulates 40 to 45 percent of automobile parts have to be made by workers who earn a minimum of US$16 an hour by 2023. It is intended to prevent jobs in the US and Canada from going to Mexico or Asia where wages are lower and workers are not unionised.

Due to these requirements, automobiles in the US will likely cost more than they did under NAFTA. However, cars from outside North America will be even more expensive. The top five biggest car exporters to the US are Canada, Japan, Mexico, Germany and South Korea.

China sits in 10th place. There are only two Chinese-assembled models – the Buick Envision and Volvo S60 – that are sold in the US. However, practically every vehicle contains China-made components.

A large number of Asian and European automakers have manufacturing facilities in North America and partially import some models. Honda has 12 plants in the US to make parts and assemble vehicles, boasting a 75 percent domestic content.

Toyota imports 22 percent of all the vehicles it sells in the US; Nissan, 31 percent; Hyundai imports almost 50 percent.

Shifting tides

As automakers shift their production to North America, this will impact their output elsewhere in the world.

Auto parts manufacturers will also be hit hard. Parts used in assembly may cross several borders, sometimes going back and forth in different stages of production. This will incur multiple tariffs with each border crossing. The component industry may see a major shift from Asia to Mexico.

This will also have a knock-on effect on the supply chain spread throughout ASEAN member states. Vehicle and parts makers may be forced to seek markets elsewhere.

Source: Office of the US Trade Representative

Source: Office of the US Trade Representative

The USMCA also covers intellectual property, extending the terms of copyright to 70 years (from 50) after the author’s death. Patents for pharmaceutical drugs will also be extended from eight to 10 years, giving them longer protection from generic substitutes.

New digital provisions in the agreement declared no duties to be imposed on electronically-purchased products such as e-books and music. Internet companies were also given protection against liability for content produced by their users.

The USMCA is notable for including a clause against pursuing separate free trade agreements with a “non-market economy”. China and Vietnam have non-market economy status in the World Trade Organisation (WTO), which means they do not operate on free-market principles where a product’s price reflects its true value.

Dubbed the “Trump veto” clause, all three countries must give three months’ notice before commencing free trade talks with a non-market country. They must also provide documentation of the deal in advance. If any of the signatories is unhappy with that agreement, it has the right to walk away from the USMCA.

The impact of the USMCA will not be felt immediately. Although the three countries plan to sign the agreement before the end of November, their respective governments must ratify it first.

Mexico’s president will be leaving office on 1 December but his successor said he will not try to renegotiate the deal. Canada’s Prime Minister Justin Trudeau is expected to get his government’s approval before next year’s federal election.

However, the US is preparing for midterm elections on 6 November and its Congress is unlikely to consider any agreements until 2019. If the Democrats gains control of either the House of Representatives or Senate, it may not support the Trump administration’s plans.

Related articles: