Offering investment opportunities in everything from zippers to bullet trains, Vietnam has long been recognised as a hub for foreign direct investment (FDI) – and a recent report has just confirmed that.

The United States (US) News and World Report last month ranked Vietnam eighth in a list of 29 best economies to invest in, and the next closest ASEAN countries on the list were Malaysia (13th), Singapore (14th) and Indonesia (18th). Uruguay topped the list, followed by Saudi Arabia, Luxembourg, India and Poland.

Since introducing market-oriented policies under its Doi Moi (renovation or reform) programme in the 1980s, Vietnam’s economic growth has been among the fastest in the world – and FDI has played a large part in that by attracting investment in a variety of sectors.

The world’s largest zipper manufacturer, Japan’s YKK Corporation started operations at its second plant in Vietnam last week having invested US$60 million in the facility in the northern province of Ha Nam, around 40 kilometres (km) south of Hanoi.

Meanwhile in May, South Korea’s Hyundai expressed interest in investing in the North-South bullet train project which will connect Hanoi to Ho Chi Minh City – a distance of more than 1,500 km – and is expected to cost nearly US$58.7 billion.

Strong track record

The US News and World Report’s rankings were derived from the results of a global perceptions-based survey which saw nearly 7,000 business decision makers rank countries based on eight equally weighted country attributes; economic stability, favourable tax environment, skilled labour force, technological expertise, entrepreneurship, innovation, dynamism and corruption.

Vietnam ticks all the right boxes, and its foreign direct investment (FDI) has grown from US$11.5 billion in 2008 to US$35.46 billion last year.

A total of 112 countries and territories invested in the country in 2018, with Japan leading the way with US$8.59 billion – followed by South Korea (US$7.2 billion) and Singapore (US$5 billion).

The country’s manufacturing and processing sector has traditionally gained the most interest from foreign investors, and the two sectors attracted US$16.58 billion in FDI last year – followed by the real estate sector (US$6.6 billion) and retail sector (US$3.67 billion).

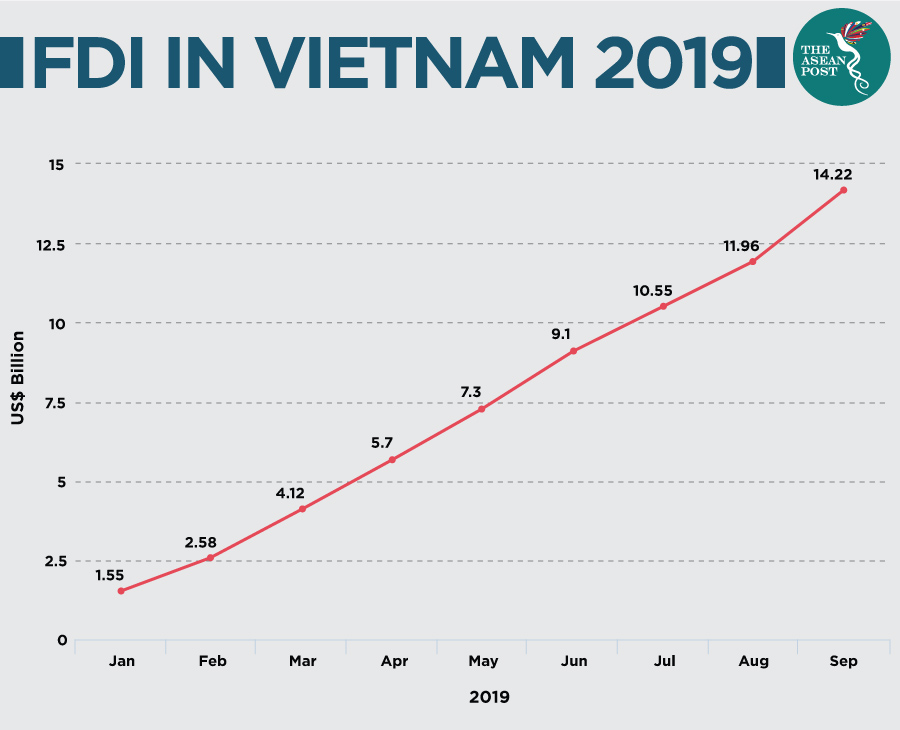

This year’s statistics are equally impressive.

The country’s Foreign Investment Agency (FIA) last month announced that a total of US$14.22 billion in FDI has been disbursed so far this year – a 7.3 percent year-on-year increase – and 2,759 new projects with a total commitment of US$10.97 billion have been approved.

The US News and World Report isn’t the only one to have taken notice of Vietnam’s prowess as a FDI hub.

Just yesterday Vietnamese media reported that Sam Cheong Chwee Kin, Executive Director and Head of United Overseas Bank (UOB) Group’s Foreign Direct Investment Advisory Unit, praised the country as a bright spot in FDI attraction in ASEAN.

He paid special attention to the Vietnamese government’s efforts to bolster infrastructure at key economic and industrial zones such as the northern port city of Hai Phong, which has helped develop the country’s north eastern region.

Vietnam began establishing special economic zones (SEZs) to attract labour-intensive manufacturing in the late 1990s and 2000s, and between 60 to 70 percent of all FDIs are in these SEZs.

Low wages, high tax breaks

Drawn to Vietnam by its competitive costs, low wages and developed infrastructure, investors have another reason to stay when they find out about the tax incentives which are applied to a variety of industries and projects throughout the country.

“Vietnam has quietly developed one of the most competitive tax regimes in Southeast Asia,” said Koushan Das, who oversees projects in India and ASEAN for business consultants Dezan Shira & Associates.

“Foreign investors, particularly those involved in slightly higher value-add production, should be able to use incentives… to position themselves ahead of their competitors in the years ahead,” added Das.

Other factors such as the US-China trade war have also played a part in recent FDI flow by moving some Chinese production bases to Vietnam – with Hong Kong standing

out as Vietnam’s largest investor this year with US$5.89 billion.

However, the trade war has only accelerated a trend which has been years in the making – that of Chinese companies deciding whether to invest in labour-saving automation technologies or to relocate to areas which offer cheaper labour.

While labour costs may be comparatively lower in Vietnam, the country has emphasised the importance of developing skilled labour as a key factor in encouraging FDI – while also encouraging innovation and increased use of new technologies.

Although Vietnam’s labour productivity has improved over the past decade, it is still low in comparison with other ASEAN members – making this arguably the country’s biggest challenge in maintaining its status as a regional investment hub.

Related articles:

Vietnam, the land of the 'Ascending Dragon'