Southeast Asia is a growing region with countries here averaging growth rates of 5.1 percent. This situation has rightly prompted a rise in energy demand within the region. Between 2000 and 2016, economic growth in the region spurred a 70 percent increase in primary energy demand. To that end, governments in Southeast Asia have implemented a host of policies to ensure energy demand is met.

On a regional scale, the ASEAN Power Grid (APG) slated to span the length and breadth of the 10-member states of the Association of Southeast Asian Nations (ASEAN) was initiated in the late 1990s. Essentially, the grid represents a forward-thinking vision to enhance cross border electricity trade in the region which would help undergird rising electricity demand.

The expansion of the regional electricity grid cannot be undertaken without foreign investment, thus presenting a lucrative win-win opportunity for foreign investors. Numbers by the International Energy Agency (IEA) indicate that the region would require US$1.2 trillion in investments between now and 2040 in order to modernise and expand its electricity grids.

Prominent investors in the electricity sector include China, Japan, European nations, the United States (US) as well as several multilateral banks and financial institutions.

For China, the clear motive for their investment is to further entrench their economic and political relationships with countries in the region – some of which border its southern regions. Since 2003, China has invested US$66 billion in power generation in Southeast Asia, representative of 48 percent of its total investment globally in that regard.

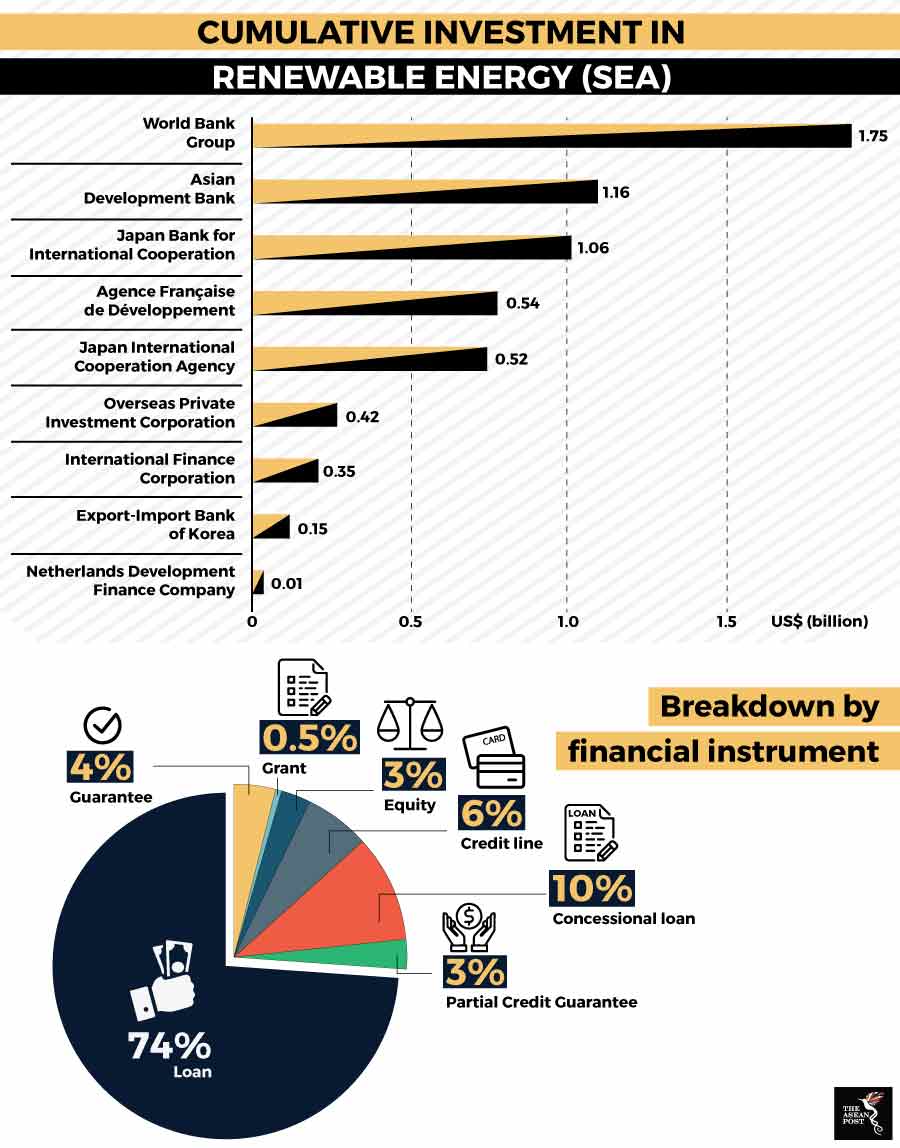

Japan on the other hand, has been actively investing upwards of US$1.5 billion in hydro, solar and wind projects in the region since 2009. Its neighbour, South Korea has also shown interest with the Export-Import Bank of Korea investing US$150 million in renewables in Southeast Asia between 2009 and 2016. Seoul’s New Southern Policy, initiated in 2017 promises to further increase energy cooperation with its counterparts in Southeast Asia.

Outside of Asia, the US’ Overseas Private Investment Corporation has invested over US$400 million between 2009 and 2016. Moreover, the US Agency for International Development is set to pump in US$750 million to bolster the renewable energy capacities of ASEAN member states.

In Europe, investment interests come mainly from Germany. Germany’s development organisation, the Gesellschaft für Internationale Zusammenarbeit (GIZ), has been actively partnering with the ASEAN Centre for Energy via the ASEAN-Germany Energy Programme (AGEP). The GIZ has assisted and funded a host of activities aimed at improving regional and technical cooperation between Germany and ASEAN states.

Source: International Renewable Energy Agency

Multilateral banks like the World Bank and the Asian Development Bank (ADB) have played a crucial role in facilitating renewables deployment in the region. Both financial institutions have invested over US$2 billion and US$1 billion, respectively in Southeast Asia’s renewable energy sector since 2009.

Going green

Most investments from China, Japan and South Korea focus on non-renewables like coal, notwithstanding an increased urgency in investing in renewables especially in hydropower and solar.

In Indonesia, these three countries have participated in 18 coal projects between 2010 and 2017. In financing such projects, they needn’t look too far off, as Singapore’s top three banks – DBS Bank, Oversea-Chinese Banking Corporation (OCBC), and United Overseas Bank (UOB) – provided necessary funding for 21 coal projects from 2012 to 2018. Over half these projects were coal-fired power plants in Vietnam and Indonesia.

Implementing renewable energy initiatives is easier said and done. ASEAN aims to secure 23 percent of its primary energy mix from renewable resources by 2025. Based on policies that are being currently practiced and that are in consideration for the future, the region’s renewable energy share in its primary mix is only slated to reach 17 percent by 2025, leaving a six percent gap between target and actual rate of adoption.

Nevertheless, the dwindling costs of renewable energy has further strengthened the business case for turning to renewables. According to the International Renewable Energy Agency (IRENA), the cost for solar photovoltaics (PV) fell 45 percent – the most among other renewable power sources – between 2012 and 2016 from US$3,915/kilowatt (kW) to US$2,134/kilowatt (kW). Onshore wind experienced a similar cost reduction between 2013 and 2016 from US$2,627 to US$2,342.

The nexus of economic growth and energy demand will be a continuous dilemma for lawmakers and investors alike. With lucrative foreign investments knocking on the doors of countries in the region, governments must be put to task in ensuring investments within their respective borders are reflective of this shared green future.

Related articles:

Regulating renewable energy investments