Frustrated by how long it took for that t-shirt or pair of shoes you ordered from Shopee or Lazada to arrive? You’re not the only one.

Dissatisfaction about e-commerce delivery times in Southeast Asia is nothing new, with a survey this week revealing that one in three (34 percent) online shoppers in the region are unhappy with their delivery service.

The survey conducted by Parcel Perform and iPrice Group also found that 90 percent of customer complaints and negative feedback are related to late delivery or a lack of communication about delivery statuses – noting that this then affects customer satisfaction and retention. Parcel Perform is an e-commerce parcel tracking platform while iPrice offers price comparisons on products and brands.

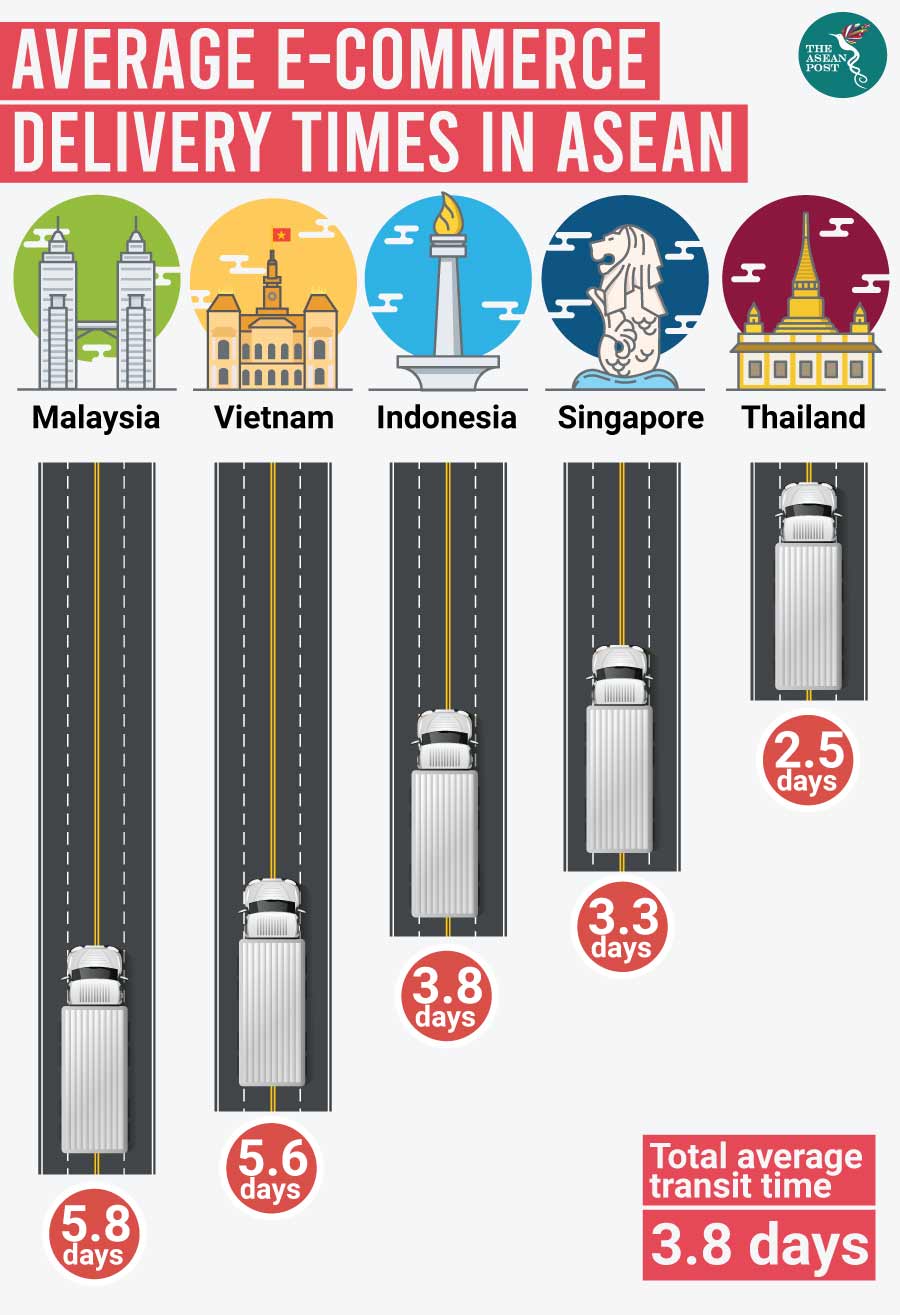

In general, the study of 80,000 e-commerce consumers found that those in Singapore, Thailand, and Vietnam are more satisfied with their e-commerce delivery experiences than those in Indonesia and Malaysia.

As transit times increase, happy customers (defined as those with a satisfaction rating of four to five) decrease by 10-15 percent for each time bracket. Faster parcel deliveries lead to higher customer satisfaction ratings, and the direct relationship between parcel transit time and customer satisfaction ratings shows that quick, punctual and responsive customer service continues to rank high in importance in e-commerce customer satisfaction.

However, customers’ expectations on delivery can be managed successfully if merchants keep them in the loop with regular delivery notifications and updates.

‘Constant communication and engagement’

“Due to the proliferation of options in online retail today, consumers in Southeast Asia are extremely savvy e-commerce shoppers and are increasingly more discerning when it comes to selecting when, how and who they purchase from,” said Jeremy Chew, Head of Content Marketing, iPrice Group.

“Besides making price comparisons across platforms, consumers are also getting more demanding in the post-purchase delivery process. Merchants will have an edge if they provide a fully visible post-purchase delivery experience with constant communication and engagement.”

The finding that Malaysia’s e-commerce delivery times were the worst among the five countries in the survey may not come as a surprise for online shoppers in Malaysia.

Speaking to Malaysian media earlier this month, Ian Ho, Shopee regional managing director said they were working with their logistics partners to shorten delivery times – especially during peak or festive seasons when there are spikes in demand.

Ho noted that efficiency could also be improved during packing, especially with merchants who are used to B2B (business-to-business) operations – which only require them to send entire boxes of their products to stores, which would then have to be repackaged for retail sales. This is in comparison to B2C (business-to-consumer) operations, where companies would have to spend more time packaging and delivering their products to individual customers.

Surge in demand

Such challenges are an unwanted side-effect of e-commerce’s rapid rise in ASEAN – where deliveries have grown from 800,000 per day in 2015 to more than three million per day in 2018 according to a report by Google and Singapore’s sovereign wealth fund, Temasek, last year.

E-commerce has been the most dynamic sector of the digital economy in the last few years, and the report noted that while it accounted for just over US$5.5 billion in gross merchandise value (GMV) in 2015, e-commerce has grown more than four times since then and exceeded US$23 billion in 2018. In just six years’ time (2025), that sum is expected to reach US$100 billion on the back of increased consumer trust and confidence.

Platforms such as Shopee and Lazada are now among the most trusted names in e-commerce, and they were the top two most visited e-commerce platforms in Southeast Asia with a total average of 184.8 million visits and 179.7 million visits respectively in the first quarter of 2019 according to a recent study by iPrice Group and App Annie – an app analytics platform. Tokopedia, which is only available in Indonesia, was the third most visited e-commerce platform in Southeast Asia. Collectively, it is estimated the three platforms have grown more than seven times since 2015, well above the rest of the sector.

The trio’s success comes down to their tens of millions of products on offer, world-class mobile user experiences, frequent consumer promotions and far-reaching logistics networks – all of which have made them a firm favourite for online shoppers. As Southeast Asian consumers – especially those unserved by urban retail outlets – increasingly rely on these platforms to make shopping easier and cheaper, it will take a lot more than a late delivery or two to break e-commerce’s dominance in Southeast Asia.

Related articles:

E-commerce fuels region’s internet economy