When the Coalition of Hope (Pakatan Harapan) unveiled its first ever budget as Malaysia’s new ruling coalition, one of the key points that caught the attention of Malaysians was the taxing of imported services, including online services.

In November 2018 – when Malaysia’s 2019 budget was tabled – the country’s Finance Minister Lim Guan Eng revealed that the government would impose and remit a tax on online services such as software, music, video and digital advertising beginning January 2020. These online services would also have to register with the Royal Malaysian Customs.

On 30 December, Malaysian media reported the Royal Malaysian Customs as confirming that as many as 126 foreign digital service providers including Google, Netflix, Spotify, and Airbnb had registered with the government for the six percent digital tax.

Local media cited a Malaysian Customs spokesman as confirming the list as of 20 December, with other companies to be invited to register.

“As of now, we do not know how many foreign companies are eligible, so the implementation of the tax will be based on the soft approach. This means we will provide notices inviting such companies to register for the tax, should the company reach the threshold,” the spokesman was quoted as saying.

Foreign companies providing digital services are required to register with the Customs Department for the digital tax if the value of such services to Malaysian consumers exceeds RM500,000 (US$121,711) a year.

While it would make sense that Malaysia would want to ensure that it benefits from the money being made within its borders, there is a risk: foreign online companies bumping up prices of their services to make up for the tax.

A big reason why there was pushback against the goods and services tax (GST) implemented by Malaysia’s previous government was because it caused many goods and services providers to hike their prices to make up for the tax. Therefore, it would not be too far-fetched to believe that most Malaysians would be worrying about the same thing happening with their favourite foreign online services. Recent news reports, in fact, have revealed that Netflix will indeed be increasing its subscription costs.

However, this is not where the chain of events could possibly end.

Piracy

For a long time before the advent of streaming services like Netflix and Spotify, many Malaysians knew how to download their favourite movies and music illegally through torrents. To a large extent – though the government has been trying hard to shut these sites down – this is still happening.

Streaming services provided a viable option where – while not free – one could legally watch and listen to the movies and music they preferred at a reasonable price. In essence, streaming services act as a convenient bridge between not having a choice – as is the case with terrestrial TV and radio – to having to buy either CDs, DVDs or digital files.

The one key thing that illegal torrents have over streaming services, however, is that they are free.

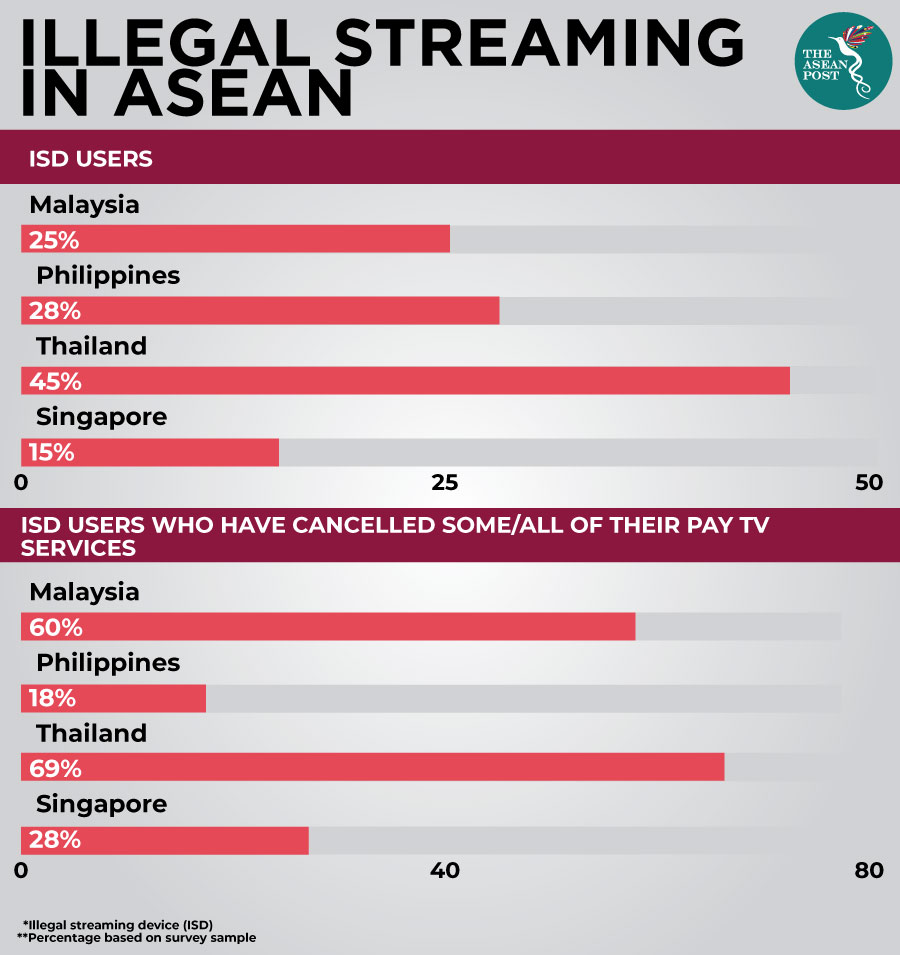

Between November 2018 and February 2019, a series of surveys commissioned by the Asia Video Industry Association's (AVIA) Coalition Against Piracy (CAP) found that 25 percent of Malaysians use illicit streaming devices (ISDs). Of that 25 percent, 60 percent have cancelled some or all of their pay TV services.

It’s a given that piracy hurts numerous industries involved either in filmmaking or in music making. But piracy is also intricately linked to malware, ransomware and spyware. Piracy websites and applications have been found to contain increased risks of malware infection, and a study by the European Union (EU) Intellectual Property Office in September 2018 revealed that most of the malware found on piracy sites could cause financial damage, data theft and other risks of unwanted access and control. Some types of malware incorporate remote access trojans which allow hackers to activate and record from a device’s webcam.

As mentioned earlier, it is completely understandable that Malaysia’s government would want to ensure that the country does not lose out on tax from foreign companies selling their online services in the country. However, for this to work, the government must ensure that these foreign companies are able to retain their customers despite the tax.

Related articles: