The global Islamic finance market is growing moderately, because of the strong investments in the Halal sector, infrastructure, and Sukuk bonds. In 2018, Brunei hosted the Brunei Islamic Capital Market (BICAM) Conference, at the Rizqun International Hotel where more than a dozen international experts in Islamic finance met, deliberated and raised awareness on growing Islamic capital markets. All those interested in understanding the role of Islamic capital markets in catalysing economic growth in the region were invited to the conference, organised by Brunei’s Centre for Islamic Banking, Finance and Management (CIBFM) along with the Global University of Islamic Finance (INCEIF).

It was reported that Brunei earmarked a total of B$414.7 million (US$306.3 million) to finance the establishment of the sultanate's stock exchange, of which B$22 million (US$15 million) has been included in the Ministry of Finance and Economy's proposed budget for the 2019/2020 fiscal year. With plans to set up its own stock exchange, conferences like BICAM would serve to heighten interest in the potential opportunities this burgeoning capital market presents.

Brunei’s interest in Islamic finance is certainly expected as the number of Muslims around the world in general and in the region specifically is expected to grow. The Pew Research Centre forecasts that the number of Muslims around the world is expected to increase steadily to 26.5 percent in 2030, 28.1 percent in 2040, and 29.7 percent in 2050, placing it as the second largest growing religion in the world after Christianity.

Booming industry

Over the past decade, Islamic finance has grown at a significant yearly pace of 10 to 12 percent. International conferences on Islamic finance are being held almost every month around the world, hosted by countries such as Argentina, Spain, France, Turkey and many more. As of July 2018, it was reported that Islamic finance was a US$2.2 trillion industry, spread over more than 60 countries and expected to grow to US$3.8 trillion in value by 2022.

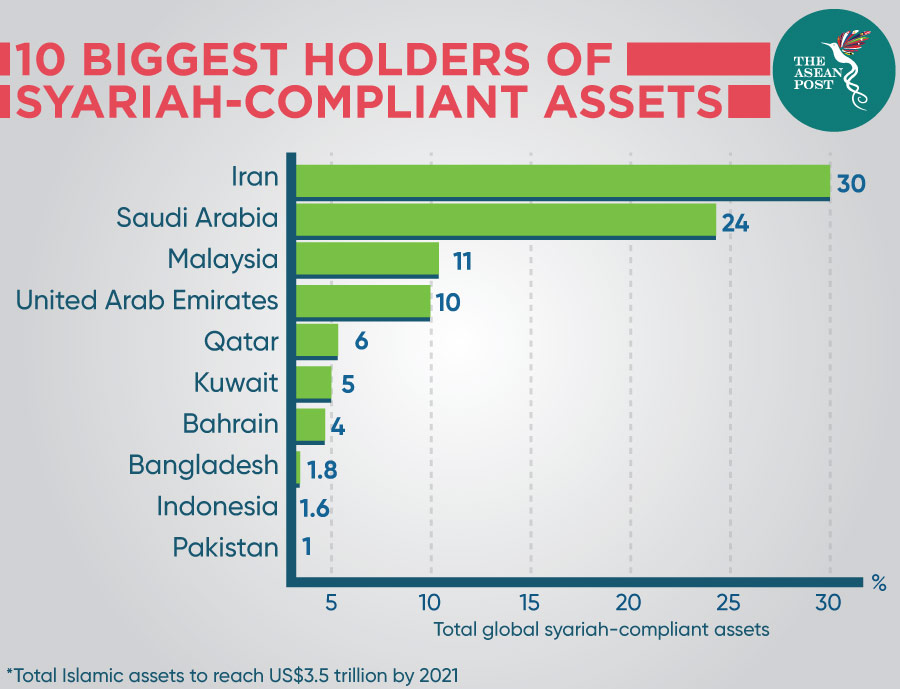

According to the Union of Arab Banks, 10 countries account for 95 percent of the world’s Syariah-compliant assets with Iran leading the way at 30 percent of the global total. This is followed by Saudi Arabia at 24 percent, Malaysia at 11 percent, the United Arab Emirates at 10 percent, Qatar at six percent, Kuwait at five percent, Bahrain at four percent, Bangladesh at 1.8 percent, Indonesia at 1.6 percent and Pakistan at one percent.

Total Islamic assets are expected to reach US$3.5 trillion in value by 2021. However, this could change as all the assets are dependent on the economic well-being of the 10 markets they are located in.

Learning from Malaysia

Sukuk – also referred to as “sharia compliant” bonds – is thriving in Malaysia. The country accounts for 82 percent of Southeast Asia’s total sukuk outstanding and 72 percent of the region’s issuances.

In June 2017, Malaysia broke new ground in sukuk development when it issued the world’s first ever green sukuk, amounting to US$58.4 million in value. The funds are being used to finance a major solar-power project in the East Malaysia state of Sabah.

Malaysia’s performance in terms of its Islamic finance institutions can be attributed to its research into Islamic finance as well as educating and creating general awareness of Islamic finance across its banking sector. Just last year, Global Finance – a global news and insights portal for corporate financial professionals – listed Indonesia and Malaysia as having the best Islamic finance institutions in the world.

While Brunei is no amateur when it comes to Islamic finance, it would be wise to learn from its trailblazing neighbours.

Brunei’s oil reserves are expected to run out by 2035. The country has already expressed its interest in looking at tourism to diversify its economy. Islamic finance seems to be a logical pairing to that and may provide Brunei with the extra push it needs to meet the challenges of the future.

Related articles: