Global demand for personal luxury goods has been steadily increasing for decades, resulting in an industry worth US$308 billion in 2019. However, the coronavirus crisis has hurt major industries and even negatively affected livelihoods and the economy in general.

Fast-fashion brands have even closed down their retail stores, one by one. Multinational clothing-retail company Hennes & Mauritz (H&M), Victoria’s Secret and Zara have all announced plans of closing down multiple outlets across the globe permanently.

Unfortunately, some brands will even be shutting down all their stores for good. Espirit, a publicly owned manufacturer of clothing, footwear, accessories, jewellery and housewares – has closed down all its Asia stores outside China, namely in Malaysia, Singapore, and Macau, among others in June 2020. Whereas famous fashion brands J.Crew, Aldo and Muji have filed for bankruptcy during the pandemic.

Although the worldwide fashion/luxury retail industry might have been hit hard by the coronavirus crisis in the first half of 2020, a recent study suggests that the industry – particularly in Southeast Asia – can perhaps survive the aftermath of the pandemic.

A recent report by e-commerce aggregator, iPrice Group revealed that Southeast Asians are looking for high-end brands online even more so after the pandemic struck. The report noted that as the region’s consumers are restricted from visiting physical stores due to the virus, there is an increase in Google impressions on the top luxury and sports fashion brands on iPrice’s platform.

Comparing January and February’s impressions versus May and June’s, iPrice concludes that French luxury retail brands garnered the most interest. Consumers were also most interested in their skincare products (which increased by 1,205 percent) and their bags (877 percent).

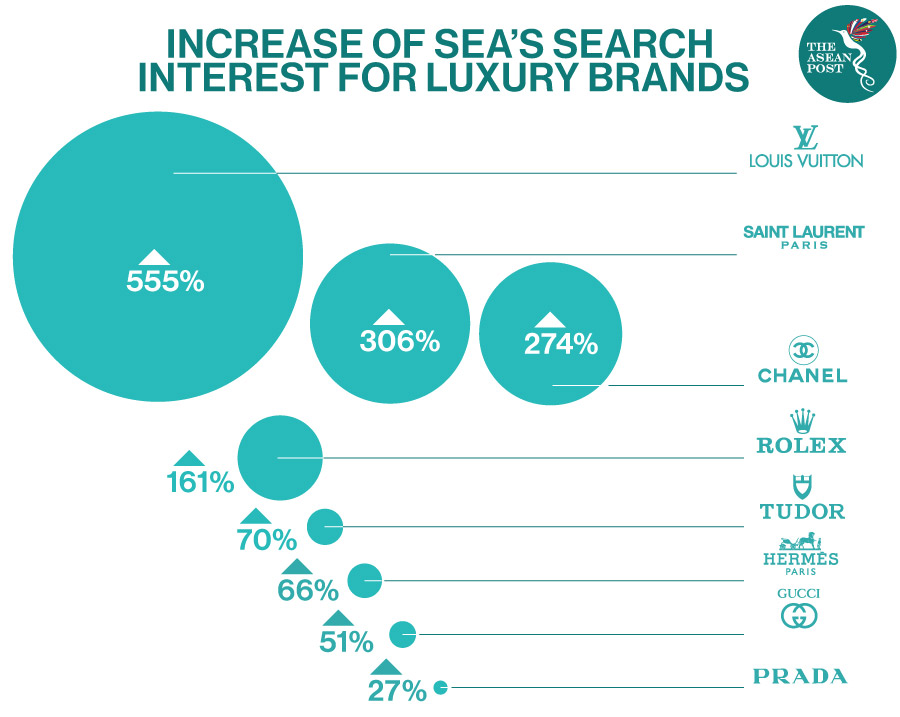

According to iPrice, Louis Vuitton’s searches increased by a whopping 555 percent. This was followed by another French luxury fashion house, Yves Saint Laurent, with an increase of 306 percent. Lastly, Chanel comes in third place as its Google search impressions increased by 274 percent.

Other Brands

The iPrice report also found that Southeast Asians are still looking into investing in luxury watches during this pandemic. Luxury watch brands Rolex and Tudor received an increase of 160 percent and 51 percent in searches, respectively, amid the pandemic.

Nevertheless, media reports in the United States (US) have stated that luxury Swiss watch exports dropped 21.9 percent overall in March by value compared with the previous year. But with Southeast Asia’s increased interest, “the future of these Swiss watches, albeit uncertain, might not be so bleak,” said iPrice in its report.

Although not considered luxury brands, iPrice Group has also included sportwear giants such as Nike and adidas in its research to see if the region’s consumers are still interested in the luxury sneakers that brand houses make at this time of crisis. Interestingly, Nike had a major increase of 605 percent in impressions while adidas’ impressions increased by 557 percent. The report cited that an interest among consumers to be more physically active when confined at home during lockdowns to be one of the reasons for the increase.

Online Shops

Although industries and livelihoods have been severely affected by the pandemic, interest in fashion brands has not wavered, as proven by the iPrice study.

“SEA consumers are still searching for luxury and fashion items despite the worldwide pandemic. It’s just a matter of where the interest is located; in this case, the interest moved from physical to online platforms.”

In China where consumers account for roughly one-third of global luxury sales, fashion brands are now turning to the populous country with aggressive digital campaigns to cushion the coronavirus blow. As most Chinese shoppers typically do their shopping overseas, luxury brands such as Cartier, Montblanc and Prada have set up online shops in China in order to reach out to consumers from a distance.

According to a media report, this trend was “unthinkable even a few years ago” as the idea of selling fine leather goods and exquisite jewellery online was looked down upon by those in the industry.

"Eight years ago, it's not even a question of selling luxury online," said Pablo Mauron, China managing director at Digital Luxury Group, an agency specialising in digital marketing for luxury brands.

“The touch-and-feel experience and instore services were considered important factors in the high-end segment, but “COVID-19 really has accelerated a lot of things," he added.

Related Articles: