Vietnam is going through a transformative period. The economic reforms undertaken by the ruling Communist Party have transformed the country into one of the fastest growing economies in the world.

This year in particular has seen the communist country’s business environment grow tremendously with over 26,000 new enterprises established. In addition to that, the government there has highlighted that foreign direct investment (FDI) disbursement reached over US$3.8 billion in the first three months of this year, up 7.2 percent from 2017. Overall, the socialist state’s gross domestic product (GDP) grew by 7.1 percent year on year in the first six months of 2018 – the fastest growth recorded since 2011. Among the best performing sectors is manufacturing, with an output growth of 13 percent in the first half of 2018.

To achieve much greater heights, Vietnam understands that investments in infrastructure are also required. Economists have long suggested that investment in infrastructure will have a multiplier effect resulting in more jobs, increased mobility and easier business transactions which will create a more vibrant economy.

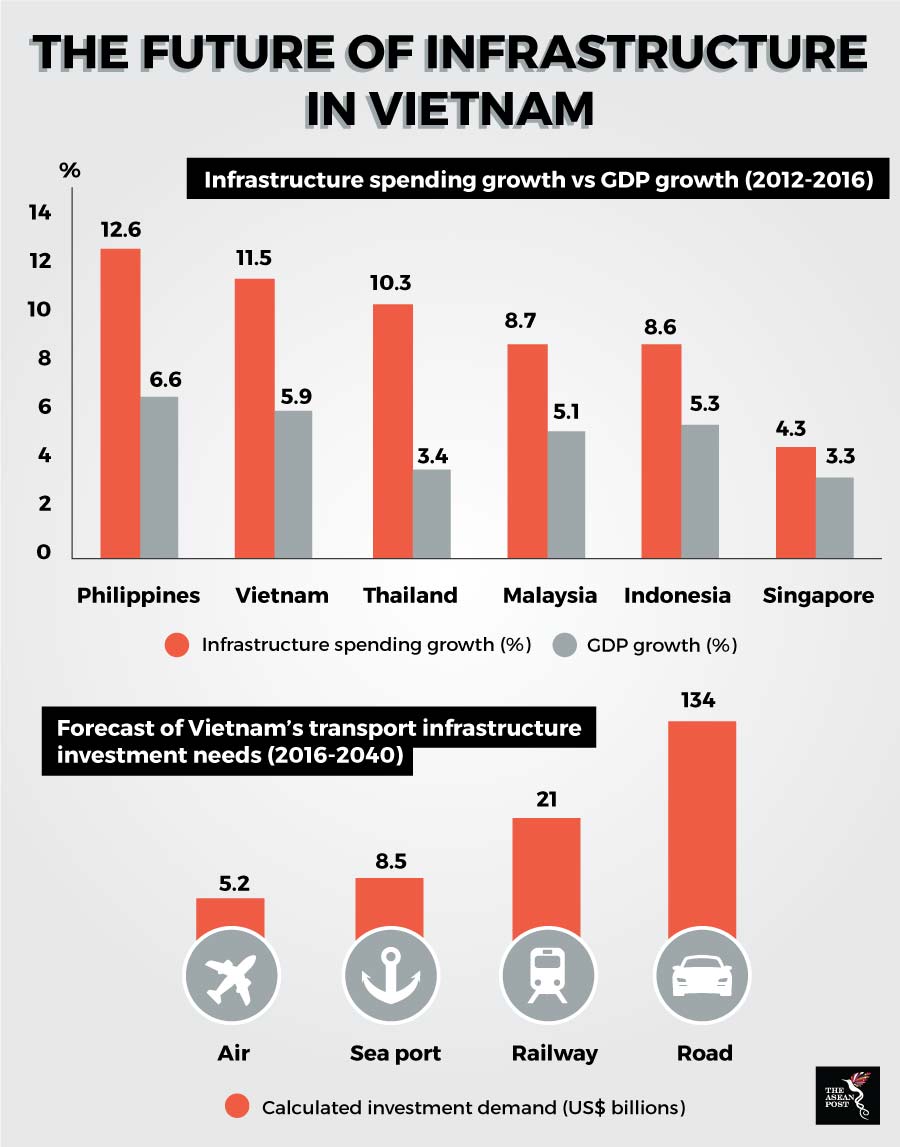

In Vietnam, the focus of its infrastructure reforms will mostly revolve around the transport and logistics sectors. According to a PwC report, there is a growing demand for more efficient transport networks that could reduce logistics costs. In economically advanced Germany, logistics costs represent about nine percent of the country’s gross domestic product (GDP) while in Vietnam, it stands at 21 percent.

Source: PwC – The Future of ASEAN: Vietnam Persepective

Source: PwC – The Future of ASEAN: Vietnam Persepective

Road and rail work

Roads are the main mode of freight transport supporting Vietnam’s development as a regional manufacturing hub. The aforementioned PwC report reveals that roads served about 77 percent of all freight transport in the country. Therefore, if Vietnam seeks economic growth, it needs to improve its road network for greater efficiency. This is why in Southeast Asia, Vietnam has the highest number of road and bridge projects in the pipeline. Within the next two years alone, the country is looking to complete the construction of 654 kilometres (km) of the proposed 1,300 km long North-South Expressway.

Vietnam also wants a much-needed upgrade to its 136-year-old railway infrastructure. At the moment, it has more than 20 rail projects in the pipeline – the second highest in the region. Some of these projects include the modernization and expansion of the national railway network and the construction of mass rapid transport (MRT) lines in Hanoi and Ho Chi Minh City. A North-South High-Speed Rail line linking major cities and economic zones across the country is also in the works.

With so many projects planned, it is no wonder Vietnam’s growth in infrastructure spending is among the highest in the region. From 2012 to 2016, Vietnam’s infrastructure spending growth was recorded at 11.5 percent per year, nearly double the 5.9 percent of GDP growth. The spending on infrastructure is not going to end soon. Data from the G20 (Group of Twenty) Global Infrastructure Outlook 2017 report shows that Vietnam will require US$605 billion in infrastructure investments by 2040.

Vietnam is not alone in its infrastructure push. It is well known that the entire region is going through an infrastructure boom. However, unlike the rest of the region, Vietnam is reluctant to take loans from Chinese firms. Many assume that Vietnam’s hesitance stems from fears that it could put itself into a debt trap.

On the other hand, the government cannot afford to completely fund these projects on its own. Instead, Vietnam is hoping that Public Private Partnerships (PPP) can help provide the necessary financing. Currently, two of Vietnam’s largest road projects, the 235 km Nha Trang-Phan Thiet Expressway (worth US$2.16 billion) and the 200 km Dau Giay-Lien Khuong Expressway (worth US$3 billion) are both PPP schemes and are due for completion by 2020.

With China not a preferred partner, Vietnam’s Minister of Planning and Investment Nguyen Chi Dung has openly encouraged Japanese firms to participate in PPP schemes. The government is also currently working on improving PPP laws to make these schemes more attractive to foreign investors.

Vietnam seems to have it all figured out. Unlike some of its neighbours who are scrambling for loans at the expense of big compromises, its careful planning and business-friendly reforms have the country moving swiftly on the right track.

Related articles:

Special Economic Zones to spur Vietnam’s growth

Challenges for the Belt and Road Initiative in Vietnam